Planning a college party can be one of the most exciting — and potentially chaotic — experiences of student life. Between securing the perfect playlist, coordinating decorations, and making sure there’s enough food and drink for everyone, it’s easy to overlook one of the most critical aspects: the budget. Without a clear plan, what starts as a fun idea can quickly spiral into financial stress, leaving organizers with an unwelcome bill and a sense of regret.

That’s where a structured approach comes in, offering clarity and control over your spending. This article introduces you to the power of a college party budget worksheet template, a simple yet incredibly effective tool designed to transform your event planning from a guessing game into a well-managed financial success. Whether you’re a seasoned event organizer, a student planning your first big bash, or part of a group looking to fundraise responsibly, this guide will show you how to leverage organized planning to keep your finances in check and your party plans on track.

The Power of Pennies: Why Organized Financial Planning Matters

In an age where financial stability is increasingly important, understanding and managing your money is a skill that extends far beyond the college years. Organized financial planning isn’t just about saving money; it’s about gaining clarity, control, and confidence in your financial decisions. For students, this means avoiding unnecessary debt, understanding where their money goes, and building healthy spending habits early on.

Whether you’re tracking daily expenses, setting aside funds for future goals, or simply trying to stay within your means, robust record-keeping is your best friend. A good expense tracker helps you see patterns in your spending, while a dedicated savings planner can turn ambitious dreams into achievable goals. When you actively engage with your finances, you move from passively reacting to money matters to proactively shaping your financial future, leading to significant peace of mind.

Unlocking Clarity: Key Benefits of Structured Budgeting Templates

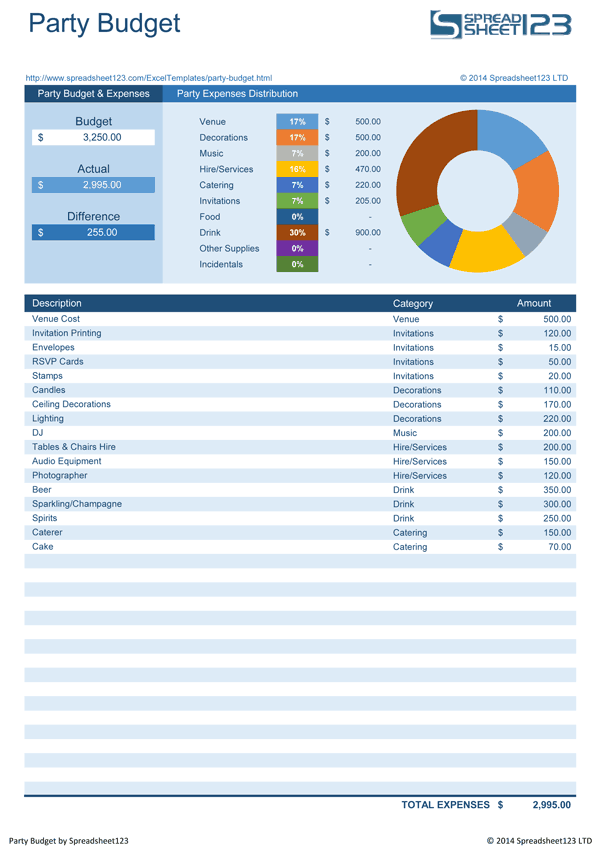

The beauty of using structured templates, planners, or spreadsheets for budgeting lies in their ability to demystify your financial landscape. Instead of vague notions about costs, you gain a crystal-clear visual overview of every dollar in and every dollar out. This makes it incredibly easy to track spending against your initial estimates, highlighting areas where you might be overspending or where you have room to allocate more funds.

Beyond simple tracking, a financial spreadsheet acts as a powerful analytical tool. It helps you identify inefficiencies, eliminate unnecessary expenses, and set realistic financial goals based on concrete data. For instance, by logging your monthly expenses and income, you can clearly see your cash flow, understand your financial capacity, and make informed decisions. This kind of diligent financial organizing not only reduces stress but also empowers you to make smarter choices, ensuring your resources are directed towards what truly matters.

Beyond the Bash: Adapting This Template for Broader Financial Health

While the focus might be on epic celebrations, the fundamental principles behind a college party budget worksheet template are universally applicable to almost any financial planning scenario. The discipline of categorizing expenses, setting limits, and tracking actual spending is a cornerstone of sound financial management, whether for personal use, a budding business, or complex event planning.

Consider how this template’s core structure can be adapted. For personal finance, it becomes an indispensable tool for managing daily spending, tracking bills, and saving for long-term goals like a down payment or further education. Small businesses can leverage its logic for project budgets, tracking startup costs, or monitoring operational expenses to maintain healthy cash flow. Even larger-scale event planning, such as weddings, corporate conferences, or community fundraisers, benefits immensely from a detailed financial organizer to manage diverse expenditures and income streams. It’s truly a versatile blueprint for effective cost management.

When and Why: Effective Uses for Your College Party Budget Worksheet Template

The college party budget worksheet template is particularly effective in situations where multiple expenses converge for a single event, and clear accountability is needed. It helps prevent misunderstandings, ensures equitable contributions, and keeps everyone informed about the financial status of the event. Here are some prime examples of when this template shines brightest:

- Annual Fraternity or Sorority Events: Managing the budget for formals, philanthropy events, or large social gatherings requires meticulous planning, especially when dealing with various vendor contracts and member contributions.

- Themed Dormitory Gatherings: From holiday potlucks to end-of-semester celebrations, dividing costs for food, decorations, and activities among residents becomes straightforward with a shared financial record.

- Graduation Celebrations: Whether it’s a small gathering of friends or a larger family affair, planning for catering, venue rental, or special mementos benefits from a detailed budgeting system.

- Study Group Social Events: Even smaller, more intimate get-togethers can benefit from tracking shared costs for snacks, drinks, or group activities outside of academic pursuits.

- Club or Organization Fundraisers: When organizing an event to raise money, accurately tracking income versus expenses is crucial for determining profitability and reporting back to members or sponsors.

- Off-Campus Apartment Parties: For students living independently, managing a party budget ensures that hosts don’t shoulder an unfair financial burden and that shared costs are transparently handled.

Crafting Your Financial Canvas: Design and Usability Tips

An effective financial planner isn’t just about the numbers; it’s also about its design and usability. Whether you prefer a physical printout or a digital spreadsheet, making the template intuitive and easy to use is key to consistent tracking and accurate record-keeping.

For print versions, focus on clarity and ample space. Use clear headings for categories like "Income," "Fixed Costs," and "Variable Expenses." Include columns for "Estimated Cost," "Actual Cost," and "Difference" to easily spot discrepancies. Provide dedicated sections for notes or specific details about purchases. A logical flow from income to outgoing expenses makes the document easy to follow and update by hand.

For digital versions, harness the power of technology. Utilize spreadsheet software like Excel or Google Sheets to automatically calculate totals, differences, and remaining funds. Conditional formatting can highlight when you’re over budget in a specific category. Linking the spreadsheet to cloud storage allows for easy collaboration if multiple people are contributing to the party. Consider adding an income log section for any contributions or ticket sales, and ensure your expense tracker is detailed enough for specific items like food, beverages, decorations, and entertainment. The flexibility of a digital layout means you can easily adapt the planner for different event sizes or types, ensuring it remains a dynamic and useful record over time.

Empowering Your Party Planning: A Smart Financial Move

Embracing a structured budgeting approach for your events, starting with the college party budget worksheet template, is more than just a smart financial move—it’s a step towards overall financial empowerment. By taking the time to plan and track your spending, you not only ensure your celebrations are memorable for the right reasons but also cultivate invaluable money management skills that will serve you well for a lifetime. This simple yet robust tool transforms potential financial headaches into opportunities for organized, stress-free fun.

Ultimately, the template serves as your personal financial compass, guiding you through the often-turbulent waters of event planning budgets. It’s a time-saving, stress-reducing, and financially empowering solution that puts you firmly in control. So, before you finalize that guest list or send out those invitations, invest a little time in setting up your financial record. Your future self—and your wallet—will thank you for the clarity, confidence, and control this smart budgeting system provides.