Navigating the financial side of business travel can feel like a high-wire act, balancing company expectations with your own need for clarity and proper reimbursement. Without a clear plan, expenses can quickly snowball, leading to stress, confusion, and a potential hit to your budget. That’s where a well-crafted business trip budget template becomes an invaluable asset, transforming potential chaos into calm control.

This isn’t just about tracking receipts; it’s about proactively managing your resources, ensuring every dollar spent aligns with your goals, and making the reimbursement process smoother than ever. Whether you’re a seasoned road warrior, a small business owner, or an administrative professional responsible for team travel, understanding and utilizing a robust budgeting tool can dramatically improve your financial organization and reduce post-trip headaches.

The Cornerstone of Clarity: Organized Financial Planning

Think of your finances as a complex ecosystem. Just like a garden thrives with care and planning, your financial well-being blossoms when you introduce structure. Organized financial planning isn’t just a suggestion; it’s the bedrock of sound decision-making, offering a clear snapshot of your income and outflow. This clarity is paramount, especially when dealing with the variable costs of travel.

Maintaining meticulous records allows you to see exactly where your money goes, revealing patterns, identifying areas for potential savings, and ensuring you stay within your allocated limits. This proactive approach helps prevent financial surprises and empowers you to make informed choices, rather than reactive ones. Ultimately, strong record-keeping translates into greater financial control and peace of mind, whether it’s for personal spending, business operations, or a crucial trip.

Unlocking Efficiency: Benefits of Structured Templates and Spreadsheets

In an age of endless digital tools, the power of a simple yet structured template often goes overlooked. Utilizing a dedicated financial spreadsheet or template brings a host of benefits that streamline your financial management processes. These aren’t just fancy documents; they’re strategic tools designed to enhance your productivity and precision.

One significant advantage is the ability to standardize your financial tracking. Instead of scrambling to remember categories or calculations, a well-designed template provides a consistent framework for every transaction. This consistency saves significant time and reduces the likelihood of errors, making everything from expense reporting to tax preparation much simpler. Furthermore, these structured documents serve as an excellent expense tracker, offering a tangible history of your financial activities that’s easily reviewable and modifiable.

Beyond the Briefcase: Adapting Your Budget Template for Diverse Needs

While the name explicitly references business travel, the underlying principles of a business trip budget template are remarkably versatile. The core structure—categorizing expenses, setting limits, and tracking actual spending—can be adapted to almost any scenario requiring financial foresight and meticulous record-keeping. This inherent flexibility makes it a powerful financial organizer for a multitude of purposes.

For personal finance, you can easily tweak the categories to manage your monthly expenses, create a detailed savings planner, or even map out a long-term investment strategy. Small businesses can leverage the layout for project-specific budgeting, tracking operational costs, or developing a comprehensive balance sheet. Event planning, from weddings to corporate conferences, benefits immensely from a structured cost management system. Even for household management, this sheet can become your go-to income log, helping you track utilities, groceries, and other family expenditures, ensuring healthy cash flow.

When a Business Trip Budget Template Shines Brightest

There are specific scenarios where having a pre-planned, comprehensive business trip budget template moves from being merely helpful to absolutely essential. It’s during these times that the structure and foresight it offers truly prove their worth, preventing last-minute scrambles and financial headaches.

A business trip budget template is most effective when:

- You’re embarking on a multi-city or international trip: Complex travel itineraries involving different currencies, varied transportation costs, and diverse lodging options demand detailed planning to avoid overspending or missing critical expenses.

- Your company has strict expense policies and reimbursement procedures: A template ensures you categorize expenses correctly from the start, aligning with company guidelines and significantly speeding up the reimbursement process.

- You’re managing travel for a team or multiple employees: Coordinating budgets for several individuals requires a centralized system to track cumulative costs, approve expenditures, and ensure everyone stays within their allocated limits.

- You need to justify travel costs to a superior or client: Having a meticulously detailed record of planned versus actual expenses provides clear, data-driven insights, making it easy to explain financial decisions and demonstrate fiscal responsibility.

- You want to identify cost-saving opportunities for future travel: By tracking actual spending against your initial budget, you can analyze where you consistently overspend or find unexpected savings, informing better planning for subsequent trips.

- You’re a freelancer or small business owner tracking deductible expenses: For tax purposes, an organized record is invaluable. The document helps you easily identify and categorize all legitimate business expenses, ensuring you don’t miss out on potential deductions.

Crafting Your Ideal Planner: Tips for Design, Formatting, and Usability

A budget template is only as good as its usability. Whether you prefer a physical printout or a digital spreadsheet, thoughtful design and formatting can dramatically enhance its effectiveness. The goal is to create a financial organizer that is intuitive, easy to update, and provides immediate clarity.

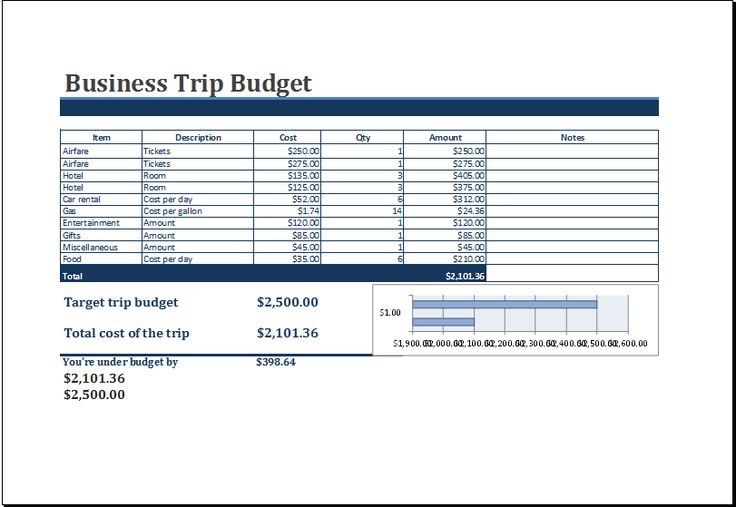

For a digital version, utilize spreadsheet software like Excel or Google Sheets. Start with clear column headers such as "Category," "Description," "Estimated Cost," "Actual Cost," "Payment Method," and "Notes." Employ basic formulas to automatically calculate totals, remaining budget, and variance, saving you time and reducing calculation errors. Conditional formatting can be a game-changer; for instance, highlight cells in red if actual cost exceeds estimated cost, providing an instant visual alert. Consider adding a separate tab for receipts or linking to cloud storage where digital receipts are kept.

If a print version suits your workflow better, ensure the layout is clean and uncluttered. Use ample white space, distinct sections for different expense types (e.g., travel, accommodation, meals, miscellaneous), and large enough fields for handwritten entries. Pre-labeling categories helps maintain consistency. For both digital and print, think about the logical flow of information. Group similar expenses together and ensure the most critical information is easily visible. Simplicity often trumps complexity; a streamlined design encourages consistent use.

Your Financial Co-Pilot: Embracing the Template’s Value

In the bustling world of business travel and intricate financial management, having a reliable co-pilot is not just a luxury—it’s a necessity. The consistent application of a well-designed financial spreadsheet, starting with a powerful business trip budget template, offers exactly that kind of support. It stands as a beacon of organization, guiding you through the often-murky waters of expenses, receipts, and reimbursements.

Ultimately, this document is far more than just a list of numbers; it’s a strategic tool that empowers you. It provides clarity, reduces stress, and saves precious time that would otherwise be spent sifting through haphazard notes or struggling with reconciliation. By integrating this powerful planner into your financial toolkit, you’re not just tracking money; you’re investing in your peace of mind and demonstrating a commitment to meticulous, smart financial planning. Embrace the power of the template, and transform your financial journeys into effortlessly managed successes.