Heading off to college is an incredibly exciting chapter, but it also comes with a significant leap in financial responsibility. Suddenly, you’re not just managing textbooks and assignments; you’re also navigating tuition fees, housing costs, groceries, social outings, and maybe even a part-time job. It’s a lot to juggle, and without a clear roadmap, it’s easy for your finances to feel overwhelming, leading to unnecessary stress. That’s precisely why having a solid financial plan, starting with a budget template for college students, is not just a good idea, but an essential tool for success.

This isn’t about restricting yourself or cutting out all the fun; it’s about gaining clarity and control over your money. Think of a budget as your personal financial GPS, guiding you toward your goals while helping you avoid unexpected detours into debt. Whether you’re a seasoned saver or completely new to managing your own funds, an organized system provides the foundation you need to thrive financially throughout your academic journey and beyond. It empowers you to make informed decisions, track your progress, and ultimately, enjoy your college experience with greater peace of mind.

The Importance of Organized Financial Planning and Record-Keeping

In today’s fast-paced world, where subscriptions and impulse buys are just a click away, having a clear financial overview is more crucial than ever. Organized financial planning isn’t merely about knowing how much money you have; it’s about understanding where every dollar goes and where it needs to go. This level of clarity helps you identify spending patterns, spot areas for potential savings, and ensure you’re on track to meet your financial objectives. It creates a robust financial organizer that you can rely on.

Effective record-keeping acts as your personal financial history book, providing invaluable insights over time. By consistently logging your income and expenses, you build a comprehensive financial spreadsheet that reveals your actual cash flow, rather than just what you think you’re spending. This detailed expense tracker empowers you to make proactive decisions, whether it’s adjusting your weekly grocery budget or planning for a larger, future expense. It’s all about putting you firmly in control of your financial narrative.

Key Benefits of Using Structured Templates, Planners, or Spreadsheets for Budgeting

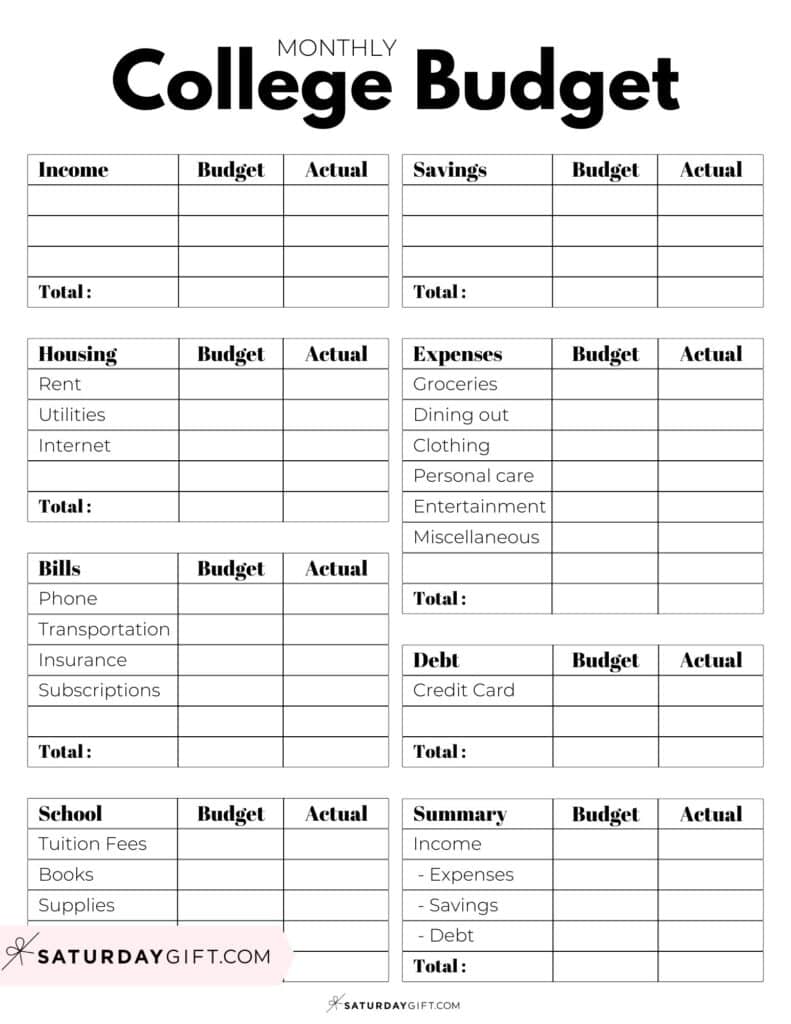

When it comes to managing your money, structure is your best friend. Relying on a structured template, planner, or spreadsheet transforms complex financial data into easily digestible information. These tools provide a standardized framework, ensuring you don’t overlook crucial categories or forget to log important transactions. They simplify the often daunting task of keeping tabs on your money.

Using such a system provides a visual representation of your financial health, making it easier to see your income log versus your monthly expenses at a glance. This visual clarity is incredibly motivating, allowing you to quickly assess your balance sheet and adjust your spending or saving habits as needed. It also helps you set realistic financial goals, like a specific savings planner for a spring break trip or a new laptop, and track your progress toward achieving them. The template acts as a constant reminder of your financial aspirations, keeping you focused and accountable.

Adapting the Template for Various Purposes

While the core purpose of a budget template for college students is, naturally, personal finance, the underlying principles of good financial organization are incredibly versatile. The same structured approach can be adapted and applied to many different aspects of your life. Understanding how to manage finances using a template is a transferable skill that will serve you well beyond your student years.

For instance, if you’re involved in a student-run small business or a campus club, this sheet can easily be tweaked to manage project budgets, track income from sales or fundraising, and monitor operational costs. Similarly, when planning a group trip or a major event, the layout can become your go-to cost management tool, helping allocate expenses, track contributions, and ensure everyone stays within budget. Even for household management, if you’re sharing living expenses with roommates, the planner can streamline rent, utility, and grocery allocations. Learning to use the template effectively now will build a powerful budgeting system that you can deploy in countless future scenarios.

When Using a Budget Template For College Students Is Most Effective

A budget template for college students is a powerful tool that can be leveraged at various critical junctures during your academic career. Its consistent use provides clarity and helps maintain financial stability. Here are some of the most effective times to deploy such a valuable resource:

- Before Freshman Year Starts: This is arguably the most crucial time to set up your budget. It allows you to anticipate costs like tuition, housing, textbooks, and initial setup expenses, providing a realistic financial picture before you even arrive on campus.

- When Receiving Student Loans or Grants: Effectively managing these funds is vital. The template helps you allocate lump sums across semesters, ensuring you don’t overspend early and run short later. It helps you see the complete picture of your available funds and how they need to stretch.

- Planning for Major Expenses: Whether it’s a study abroad program, a new laptop for your classes, or saving up for an expensive certification exam, the template provides a dedicated savings planner to track your progress towards these larger goals.

- Managing Part-Time Job Income: If you’re balancing work and studies, the planner helps you integrate your earnings into your overall financial picture, ensuring your hard-earned money is used wisely and not just dissipated.

- During Semester Breaks and Summers: These periods often bring different spending patterns or opportunities for increased income. Adjusting your record allows you to plan for travel, internships, or saving for the upcoming academic year.

- Saving for Post-Graduation Goals: Even in college, it’s wise to think ahead. Whether it’s a down payment for an apartment, a car, or funding for further education, starting to save early within your budgeting system can make a significant difference.

Tips for Better Design, Formatting, and Usability

Creating a budget is one thing; designing one that you’ll actually use consistently is another. Good design and formatting are key to making your financial record a helpful, rather than daunting, tool. Start by categorizing your expenses clearly, separating fixed costs (like rent or subscriptions) from variable costs (like groceries or entertainment). This distinction helps you identify areas where you have more flexibility to cut back.

Consider using visual elements such as color-coding different categories or integrating simple charts to represent your cash flow. A visual summary can make it much easier to quickly grasp your financial standing without sifting through rows of numbers. For digital versions, leverage formulas in a financial spreadsheet to automate calculations, reducing manual effort and potential errors. If you prefer a print version, ensure the layout is clean, with enough space for handwritten notes and clear headings. Regardless of format, regularly review and adjust the document as your income or expenses change. A budget is a living document, not a static snapshot, and its usability hinges on its adaptability.

Empowering Your Financial Future with Your Budget Template

Embracing a budget template for college students is one of the smartest financial decisions you can make during your academic career. It transcends being merely a tool for tracking money; it becomes a powerful ally in reducing stress, boosting confidence, and fostering a deep understanding of your personal financial landscape. By systematically managing your finances, you save precious time that might otherwise be spent worrying or untangling financial messes.

The true value of this template lies in its ability to empower you. It provides a clear, actionable path toward achieving your short-term spending goals and long-term financial aspirations. Whether you’re aiming to avoid student debt, save for a post-graduation adventure, or simply gain a better handle on your monthly expenses, the planner equips you with the insights and control needed to make informed choices. Start today, and watch as this simple, organized approach transforms your financial journey, turning potential anxieties into empowering achievements.