In the realm of professional and academic pursuits, the ability to communicate effectively in writing is paramount. A well-crafted letter can open doors, clarify intentions, and establish a credible personal brand. This is particularly true when navigating the critical junctures of higher education and early career development, where a college cover letter template serves as a foundational tool for presenting qualifications, expressing interest, and making a memorable first impression. It guides individuals in structuring their formal correspondence, ensuring that all essential components are included and professionally presented.

This comprehensive guide is designed for students, recent graduates, and anyone requiring a structured approach to formal communication in academic or entry-level professional contexts. By leveraging a predefined layout, users can streamline the creation of essential documents, focusing on content rather than format. Adopting a standardized template ensures that the message is not only articulate but also visually organized, reflecting a diligent and professional demeanor to recipients, whether they are admissions committees, potential employers, or scholarship providers.

The Indispensable Role of Written Communication in Professional Documentation

Written communication stands as a cornerstone of modern business and professional interaction, serving as an official record, a means of clarity, and a testament to an individual’s professionalism. Unlike transient verbal exchanges, written documents offer a verifiable account of facts, agreements, and intentions, making them indispensable for accountability and legal standing. They transcend geographical boundaries and time zones, enabling asynchronous yet precise communication that is critical in today’s globalized environment.

Effective professional documentation, including formal correspondence, reinforces an organization’s or individual’s credibility. It demonstrates an attention to detail and a commitment to clear, unambiguous messaging. A well-structured written request or notice letter leaves no room for misinterpretation, thereby reducing errors and fostering more efficient operations. This emphasis on clarity and precision is a hallmark of strong business communication, impacting everything from internal memos to external client proposals.

Key Benefits of Using a Structured College Cover Letter Template

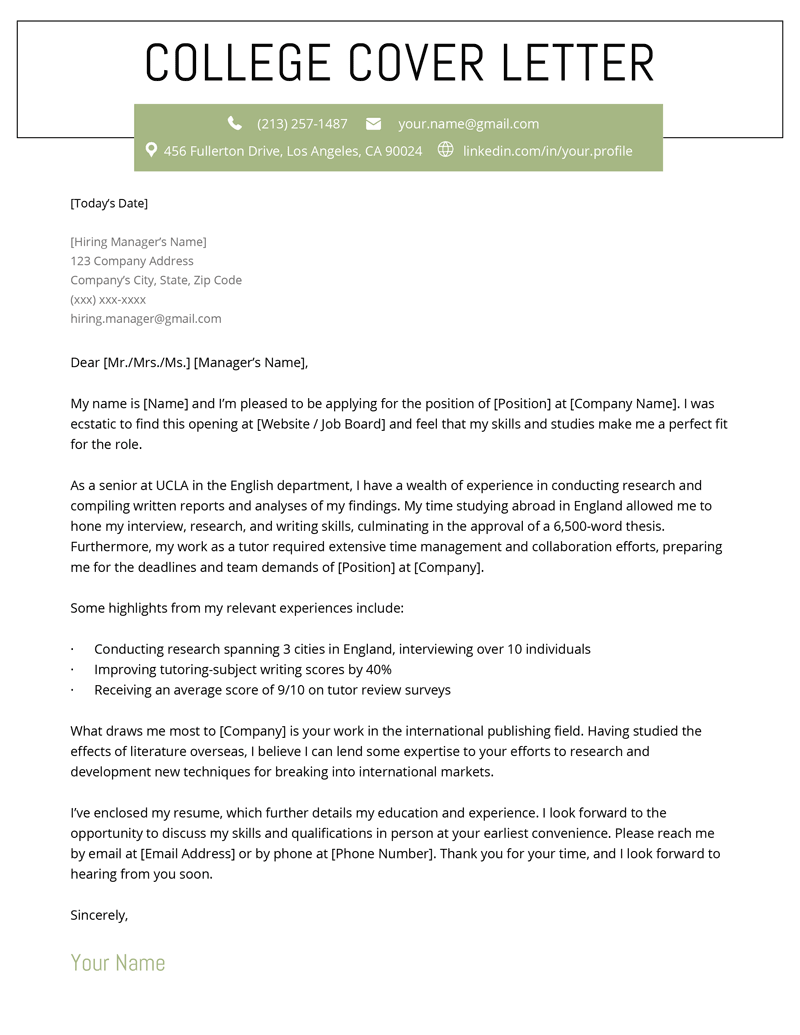

The strategic deployment of a structured college cover letter template offers a multitude of benefits, primarily centered on consistency, professionalism, and clarity in communication. By providing a pre-defined framework, the template eliminates the guesswork associated with formatting, allowing the writer to concentrate entirely on the substance of their message. This standardization ensures that every piece of formal correspondence adheres to established norms, projecting a polished and competent image.

Consistency is a significant advantage, as it guarantees that all essential elements, such as sender and recipient addresses, dates, salutations, body paragraphs, and closings, are consistently present and correctly ordered. This uniformity is crucial for maintaining a professional appearance across multiple applications or formal inquiries. Furthermore, using such a template significantly enhances clarity by encouraging logical organization of information, making the correspondence easier for the recipient to navigate and understand, thereby increasing the likelihood of a positive response.

Customizing the College Cover Letter Template for Diverse Applications

While the core structure of a college cover letter template remains consistent, its adaptability for various purposes is one of its most valuable attributes. This inherent flexibility allows users to tailor the content and specific sections of the document to suit a wide array of formal communication needs. The underlying layout provides a robust foundation upon which diverse messages can be effectively built, ensuring that the correspondence maintains its professional integrity regardless of its specific objective.

For employment applications, the letter can be customized to highlight specific skills, experiences, and accomplishments relevant to a particular job description, demonstrating a direct match between the candidate and the role. When used for academic purposes, such as graduate school admissions or scholarship applications, the document can emphasize academic achievements, research interests, and future aspirations. Similarly, for formal business inquiries, the template provides a structure for clearly articulating proposals, requests for information, or official announcements. Even formal notifications, like resignations or official acceptances, benefit from the structured approach of this template, ensuring all necessary information is conveyed concisely and professionally, creating an official record of the communication.

When Using the Template is Most Effective

The strategic application of this message template is most effective in scenarios demanding a high degree of professionalism, clarity, and adherence to formal communication protocols. Utilizing the template ensures that your formal correspondence stands out for its organization and thoughtful presentation. It is particularly advantageous when the stakes are high, and a favorable impression is crucial.

Here are specific instances where employing the layout is highly beneficial:

- Job and Internship Applications: Introducing yourself to potential employers and detailing how your qualifications align with specific roles.

- Graduate School Admissions: Articulating your academic background, research interests, and motivation for pursuing advanced studies.

- Scholarship Applications: Presenting a compelling case for financial aid, outlining academic merits, community involvement, and future goals.

- Formal Inquiries to Faculty or Administrators: Making requests for information, guidance, or approvals in an academic setting.

- Networking Outreach: Initiating contact with professionals in your field for informational interviews or mentorship opportunities.

- Requests for Recommendations: Formally requesting a letter of recommendation from professors or supervisors.

- Post-Interview Thank-You Notes: Reinforcing your interest in a position and reiterating key qualifications after an interview.

- Official Notifications: Submitting formal resignations, accepting job offers, or providing official updates in a professional context.

In each of these scenarios, the structured format of the letter ensures that all pertinent information is conveyed clearly and concisely, leaving a strong and positive impression on the recipient.

Tips for Formatting, Tone, and Usability

To maximize the effectiveness of any formal correspondence, careful attention must be paid to formatting, tone, and usability. These elements collectively contribute to how the document is perceived and understood by its recipient. Adhering to established professional standards in these areas elevates the quality of your communication and reinforces your credibility.

Formatting Guidelines

Standard business letter format is imperative. This includes clearly delineated sections for your contact information, the date, the recipient’s contact information, a professional salutation, the body paragraphs, a professional closing, and your typed signature. Employ professional and legible fonts such as Times New Roman, Arial, or Calibri, typically in 10-12 point size. Maintain single spacing within paragraphs and double spacing between paragraphs for readability. Ensure adequate margins (usually 1 inch on all sides) to give the document a clean, uncluttered appearance. The visual presentation of the file directly impacts its perceived professionalism.

Establishing a Professional Tone

The tone of the correspondence should consistently be formal, respectful, confident, and concise. Avoid overly casual language, slang, or jargon that the recipient may not understand. Express enthusiasm and confidence without sounding arrogant. Be direct and to the point, respecting the recipient’s time by avoiding superfluous words or lengthy sentences. The letter should project an image of a thoughtful and competent individual, capable of effective professional communication. Every sentence should serve a purpose, contributing to the overall message and objective of the letter.

Ensuring Usability Across Platforms

For print versions, use high-quality paper that presents well. Ensure the printing is clear and free from smudges. For digital versions, which are increasingly common, always save the document as a PDF. This ensures that the formatting remains consistent across different devices and operating systems, preventing any unintended layout shifts. Name the file professionally (e.g., "FirstName_LastName_CoverLetter.pdf") to aid the recipient in organization. Ensure that any embedded links are functional and relevant. The objective is to make the document easily accessible and readable, regardless of how it is received, thereby ensuring your message is conveyed without technical impediments.

A Reliable Tool for Effective Communication

Ultimately, the template stands as an indispensable tool for anyone navigating the academic and early professional landscapes. It is more than just a pre-designed layout; it is a framework that empowers individuals to craft clear, consistent, and highly professional formal correspondence. By adhering to its structured approach, writers can confidently convey their qualifications, intentions, and requests, knowing that their message will be received and understood with the utmost clarity. This systematic approach to written communication significantly enhances one’s ability to make impactful impressions in critical situations.

Mastering the use of such a standardized layout is a fundamental skill that transcends immediate academic or employment needs. It instills discipline in written expression and fosters an appreciation for organized, precise communication—qualities that are highly valued in any professional setting. As a reliable and efficient communication tool, the template helps individuals present their best selves, opening doors to new opportunities and solidifying their reputation as articulate and professional communicators.