Let’s be honest, the idea of "budgeting" often conjures images of restrictive spreadsheets, complicated math, or just plain boring financial tasks. But what if I told you that embracing a well-designed financial tool could actually be liberating, giving you more control and less stress over your money? For those of us who value productivity, organization, and smart financial planning, the key isn’t deprivation; it’s clarity. And that’s precisely what a robust daily budget template aims to deliver.

This isn’t just about tracking every single penny, though it certainly helps with that. It’s about creating a living document that reflects your financial reality, helping you make informed decisions, achieve your savings goals, and ultimately, live more freely within your means. Whether you’re a recent graduate navigating your first independent finances, a busy parent juggling household expenses, or an aspiring entrepreneur keen to keep a tight rein on business cash flow, a solid daily budget template is a foundational piece of your financial puzzle, designed to bring structure and insight to your daily spending and saving habits.

The Cornerstone of Financial Clarity: Organized Record-Keeping

In today’s fast-paced world, money can feel like it’s slipping through our fingers before we even realize it. Impulse buys, recurring subscriptions, and unexpected expenses can quickly derail even the best intentions. This is where organized financial planning and meticulous record-keeping become not just helpful, but absolutely crucial for maintaining clarity and control. Without a clear picture of your income and outflow, you’re essentially flying blind.

An effective budgeting system acts as your personal financial compass. It allows you to see exactly where your money comes from (your income log) and, more importantly, where it goes. This visibility is the first step toward making conscious choices rather than reactive ones. It transforms vague anxieties about money into concrete data points, giving you the power to identify spending patterns, spot areas for optimization, and allocate funds towards your most important goals. Think of it as creating a personalized financial organizer that provides an instant snapshot of your current situation and empowers you to project your future.

Unlocking Potential: Benefits of Structured Budgeting Templates

Moving beyond basic mental math or scribbling notes on a napkin, adopting structured templates, planners, or spreadsheets for your budgeting offers a multitude of compelling benefits. These tools aren’t just about tracking; they’re about strategic financial management and unlocking your money’s full potential. They provide a consistent framework that takes the guesswork out of managing your finances, turning a daunting task into a manageable routine.

One of the primary advantages is the immediate reduction in financial stress. When you have a clear financial spreadsheet outlining your monthly expenses, income, and savings, the fear of the unknown diminishes. You can predict your cash flow, plan for major purchases, and even build an emergency fund with greater confidence. Moreover, these structured records serve as an excellent expense tracker, helping you quickly identify discretionary spending that can be reallocated towards debt reduction or a dedicated savings planner. The visual nature of a well-designed template makes it easy to compare actual spending against planned spending, offering valuable insights into your financial behavior and fostering healthier habits.

Versatility in Practice: Adapting Your Budgeting Planner

The beauty of a well-designed daily budget template lies in its remarkable adaptability. It’s far more than a simple personal finance tool; its core principles of income tracking and cost management can be tailored to a vast array of situations. This flexible structure means that once you understand the fundamentals, you can easily modify it to suit specific needs, proving its utility across different aspects of your life.

For personal finance, the planner might focus on individual monthly expenses, rent, groceries, entertainment, and savings goals. A small business, however, could adapt this sheet to monitor operational costs, revenue streams, payroll, and project-specific budgets, essentially serving as a simplified balance sheet or cash flow statement. For household management, it becomes an invaluable tool for tracking shared bills, groceries, children’s expenses, and home maintenance. Even for event planning, the layout can be transformed into a detailed cost management system, itemizing venue fees, catering, decorations, and vendor payments, ensuring you stay within your allocated budget. The core objective remains the same: bringing order and transparency to your financial interactions.

When a Daily Budget Template Shines Brightest

While a budget template is generally beneficial, there are specific scenarios where its systematic approach truly excels, providing maximum impact and clarity. These are moments when precise financial oversight can make all the difference, transforming potential chaos into controlled success. Employing the document in these situations ensures you’re proactive, not just reactive, with your money.

Using a daily budget template is most effective when you are:

- Launching a New Financial Goal: Whether saving for a down payment, a dream vacation, or early retirement, a detailed planner helps allocate specific amounts daily or weekly, ensuring consistent progress toward your objective.

- Managing Debt Repayment: If you’re tackling credit card debt, student loans, or other obligations, this sheet provides a clear picture of how much you can realistically contribute each day or week, accelerating your repayment schedule.

- Navigating Significant Life Changes: Moving to a new city, starting a new job, or adjusting to a new family dynamic (like a new baby) all introduce new expenses and income patterns. A detailed record helps you quickly adapt and re-establish financial stability.

- Running a Small Business or Freelance Operation: For entrepreneurs, tracking daily income and expenses is critical for understanding profitability, managing cash flow, and making informed business decisions. This template can function as a foundational budgeting system.

- Planning a Major Event: Weddings, large parties, or home renovation projects involve numerous costs. Using the record to itemize every expense, from initial deposits to final payments, keeps you within budget and prevents unforeseen overspending.

- Struggling with Overspending: If you frequently find yourself wondering where your money went, a daily breakdown of transactions within the template can reveal spending habits and highlight areas for immediate improvement.

- Teaching Financial Literacy: For parents introducing budgeting concepts to older children or young adults, this sheet provides a tangible, easy-to-understand tool for learning about income, expenses, and savings.

Design and Usability: Tips for an Effective Template

A powerful budgeting tool isn’t just about the numbers; it’s also about its design, formatting, and overall usability. A well-structured layout encourages consistency and makes the process enjoyable rather than cumbersome. Whether you prefer a digital financial spreadsheet or a print-friendly version, thoughtful design choices can significantly enhance your experience with the template.

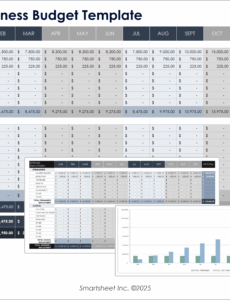

For digital versions (like Excel, Google Sheets, or dedicated apps):

- Clear Categories: Use distinct, color-coded categories for income and expenses (e.g., Housing, Transportation, Food, Entertainment, Savings). This makes scanning and analysis much easier.

- Automated Calculations: Leverage formulas for automatic sums, subtotals, and balance calculations. This minimizes manual errors and saves time.

- Conditional Formatting: Use conditional formatting to highlight over-budget categories in red or savings goals met in green, providing immediate visual feedback.

- Graphs and Charts: Incorporate simple charts (pie charts for expense breakdown, line graphs for savings progress) to visualize your financial data quickly.

- Date-Based Tracking: Include clear date columns for each transaction, allowing you to easily sort and analyze spending over specific periods.

- Dedicated Tabs: Use separate tabs for different months, annual summaries, or specific savings goals to keep the main sheet uncluttered.

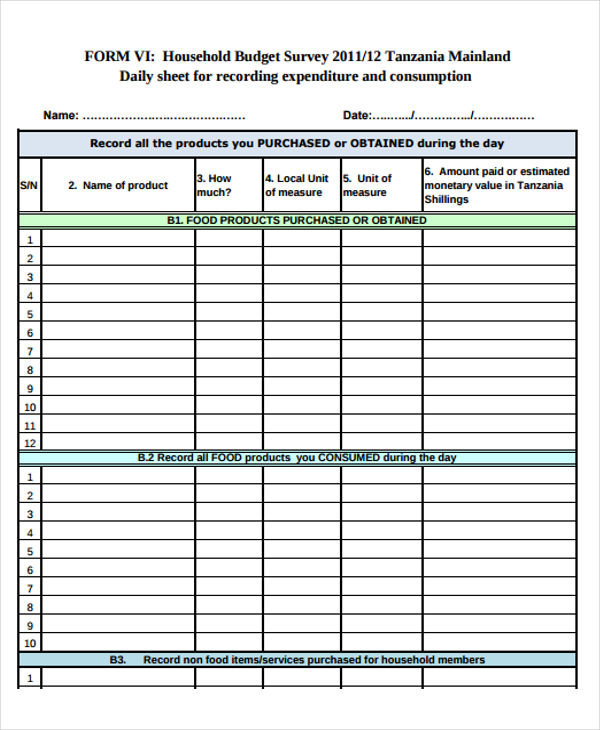

For print versions (PDF, physical planner):

- Ample Writing Space: Ensure enough room to write down transaction details, categories, and amounts legibly.

- Logical Flow: Arrange sections logically, typically starting with income, then fixed expenses, variable expenses, and finally, savings.

- Defined Columns: Clearly label columns for Date, Item/Description, Category, Amount (Spent/Received), and Running Balance.

- Monthly Overview: Include a summary section at the beginning or end of each month for total income, total expenses, and net savings/deficit.

- Binding and Durability: If it’s a physical planner, choose durable paper and binding that will withstand daily use.

- Customization: Allow for personal touches, like adding a motivational quote or a small section for financial reflections.

Regardless of format, consistent naming conventions and a clean aesthetic are paramount. The goal is to create a budgeting system that you’ll actually want to use, day after day, week after week.

Your Path to Financial Empowerment

In essence, a well-implemented budgeting system is more than just a financial tool; it’s a foundational component of a more organized, less stressful life. It transcends the basic act of money tracking, evolving into a powerful financial organizer that fosters mindful spending, intentional saving, and a clear path toward your economic goals. By dedicating a small amount of time to maintain this sheet, you gain invaluable insight and control over your financial destiny, moving from guesswork to informed decision-making.

Embracing this template is about empowering yourself. It’s about taking proactive steps to understand your financial landscape, identify opportunities for growth, and mitigate potential challenges. This practical approach not only helps you manage your monthly expenses but also serves as a robust savings planner, ensuring your long-term aspirations are consistently within reach. Ultimately, investing in the creation and consistent use of this record is an investment in your peace of mind, your financial freedom, and your ability to build the future you envision.