Let’s be honest: managing household finances can sometimes feel like trying to herd cats. There are so many moving parts, especially when it comes to the weekly (or even daily) decisions we make about food. From spontaneous coffee runs to those "just need a few things" grocery trips that somehow balloon into a hundred dollars, food spending is often the trickiest category to wrangle. It’s a non-negotiable expense, yet it’s also incredibly elastic, capable of stretching or shrinking based on our choices.

That’s precisely where a well-crafted household food budget template comes into play. It’s more than just a list of numbers; it’s a strategic roadmap for your kitchen, designed to bring clarity, control, and calm to one of your most significant discretionary spending areas. This article is for anyone who values productivity, organization, and smart financial planning – those who are ready to transform their relationship with food spending from chaotic guesswork into confident, informed decision-making.

The Foundation of Financial Clarity: Why Organization Matters

Think about any successful venture, whether it’s a bustling small business or a smoothly run household. What do they have in common? They rely on organized financial planning and meticulous record-keeping. Without a clear picture of your income and expenses, you’re essentially navigating in the dark, making decisions based on assumptions rather than concrete data.

This isn’t just about saving money, though that’s certainly a fantastic byproduct. It’s fundamentally about gaining control, reducing stress, and freeing up mental bandwidth. When you know exactly where your money is going, you can allocate it intentionally, ensuring your financial resources align with your values and goals. An effective expense tracker is the first step towards this empowerment, turning vague anxieties into actionable insights.

Unlocking Potential: Benefits of Structured Templates

In today’s fast-paced world, time is a precious commodity. Relying on structured templates, planners, or spreadsheets for budgeting isn’t just about being tidy; it’s about being efficient. These pre-designed frameworks eliminate the need to reinvent the wheel every time you want to track something, providing a consistent layout that’s easy to understand and maintain.

Using a dedicated financial spreadsheet transforms budgeting from a dreaded chore into a streamlined process. It acts as your personal financial organizer, consolidating all relevant information in one accessible place. This not only saves you time but also minimizes errors, making it easier to review your monthly expenses, project future spending, and ultimately achieve your savings planner goals. It’s an invaluable tool for effective cost management.

More Than Just Groceries: Adapting Your Budget Planner

While we’re focusing on food, the underlying principles of effective templated budgeting are incredibly versatile. A well-designed template, like the household food budget template we’re discussing, is inherently adaptable. Its core structure—tracking income, categorizing expenses, and monitoring cash flow—can be repurposed for a multitude of needs.

Imagine using a similar layout as a small business budget planner, tracking operational costs and revenue. Or, you could adapt it for event planning, managing everything from venue deposits to catering expenses. For broader personal finance, it can function as a comprehensive balance sheet, helping you monitor assets and liabilities. The beauty of a flexible record-keeping system is its ability to meet diverse organizational challenges with a consistent, reliable approach.

When a Household Food Budget Template Shines Brightest

A dedicated household food budget template isn’t just a "nice to have"; it becomes an indispensable tool in specific scenarios. It empowers you to take proactive steps towards your financial well-being and helps you make informed choices that align with your lifestyle.

Here are some examples of when using a household food budget template is most effective:

- When you’re constantly overspending on groceries or dining out: If your end-of-month bank statement always leaves you scratching your head about food costs, this sheet provides the data you need to identify patterns and make necessary adjustments.

- During periods of financial tightening or specific savings goals: Whether you’re saving for a down payment, a vacation, or just trying to build an emergency fund, trimming your food budget can free up significant funds. The planner makes this process visible and achievable.

- For meal planning and grocery list optimization: By categorizing expenses (e.g., groceries vs. restaurants, pantry staples vs. impulse buys), you can refine your weekly meal plans to be more cost-effective and reduce food waste.

- If you’re trying to identify "leakage" in your spending: Those daily coffee shop visits, vending machine snacks, or forgotten restaurant leftovers can add up. The record brings these smaller, often overlooked expenses into sharp focus.

- When transitioning to a new dietary plan or lifestyle: Whether you’re embracing more home-cooked meals, trying a plant-based diet, or managing food allergies, the template helps you track the cost implications and ensure you stay within your financial comfort zone.

- For families with growing children or changing needs: As household dynamics shift, so do food budgets. This spreadsheet allows you to track and adjust spending as appetites grow or dietary preferences evolve, ensuring everyone is fed without breaking the bank.

- Before and after major holidays or events: These periods often see spikes in food spending. Using the layout to track these unique expenses helps you budget more effectively for future celebrations and minimize financial surprises.

Crafting Your Financial Ally: Design, Formatting, and Usability

Creating a template that you’ll actually want to use is key to its success. A great design isn’t just about aesthetics; it’s about clarity, functionality, and ease of use. Whether you prefer a digital financial organizer or a printed budgeting system, thoughtful design enhances its practical value.

For digital versions, like a financial spreadsheet in Google Sheets or Excel, consider the following:

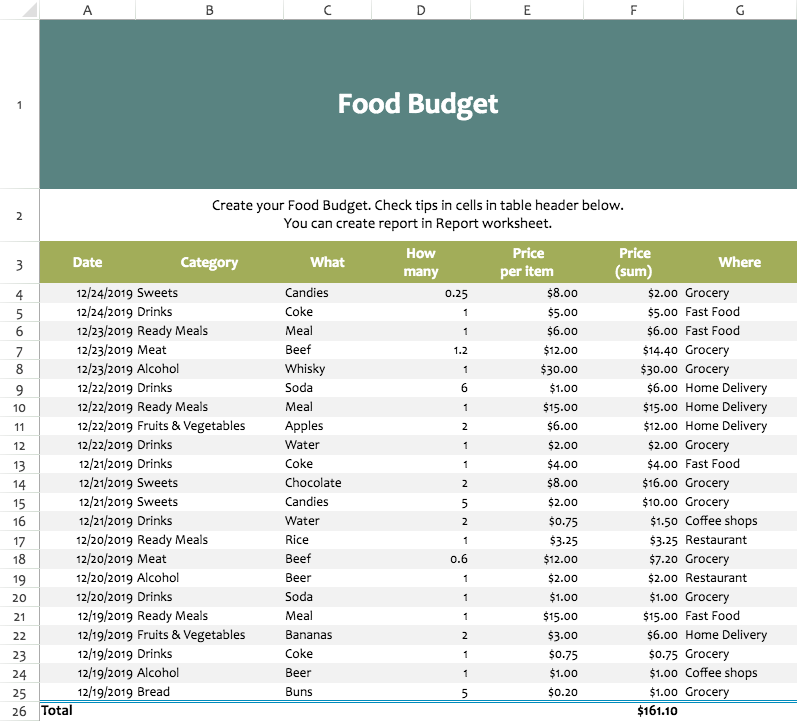

- Clear Column Headers: Use descriptive names like "Date," "Item/Vendor," "Category (Groceries, Dining Out, Coffee, etc.)," "Amount," "Payment Method."

- Automated Calculations: Leverage formulas for sums, averages, and remaining budget. A simple

SUMfunction for total monthly expenses is a game-changer for monitoring cash flow. - Conditional Formatting: Use color-coding to highlight over-budget categories or approaching spending limits. This provides instant visual cues.

- Dedicated Tabs: Create separate tabs for "Monthly Income Log," "Summary," "Receipts," or even a "Savings Planner" to keep everything organized within one workbook.

- Drop-down Menus: For categories, use data validation to create drop-down lists. This ensures consistency and speeds up data entry.

If you prefer a printed version of the document, think about these tips:

- Ample Writing Space: Ensure columns and rows are large enough for comfortable handwriting.

- Clear Sections: Use bold headings, lines, or shaded boxes to clearly delineate different sections, like "Fixed Food Expenses" versus "Variable Food Expenses."

- Binding or Folder: Keep all your printed records in a dedicated binder or folder so they’re easy to access and review.

- User-Friendly Layout: Design a flow that mimics how you naturally process information. Perhaps an initial "budgeted" column followed by an "actual" column to compare directly.

- Space for Notes: Include a small section for notes, like "Meal ideas for next week" or "Reasons for overspending this month."

Regardless of format, prioritize consistency in your data entry. The more consistent you are, the more accurate and useful your cost management insights will be. This adherence to a uniform method makes reviewing your spending and making adjustments much simpler.

Empowerment Through Organization: Your Financial Journey

Embracing a structured approach to your finances, starting with something as fundamental as your food spending, is truly empowering. The journey from financial ambiguity to clarity doesn’t happen overnight, but tools like a well-designed template make the path significantly smoother and more rewarding. It’s about more than just numbers; it’s about cultivating a mindful relationship with your money.

By consistently utilizing this sheet, you’re not just tracking expenses; you’re building a habit of intentionality, foresight, and disciplined financial management. It becomes a time-saving assistant, reducing the stress associated with monthly budgeting woes. More importantly, it acts as a financially empowering companion, providing the insights you need to make smarter choices, achieve your savings goals, and ultimately, live a more organized and abundant life.