Embarking on a journey toward financial clarity and peace of mind often starts with a single, powerful tool: a personal budget template. For many of us, the idea of budgeting can feel overwhelming, conjuring images of restrictive rules and complicated spreadsheets. However, the truth is far more empowering. A well-designed personal budget template isn’t about deprivation; it’s about gaining control, understanding your money’s flow, and building a foundation for your financial future.

This comprehensive guide is crafted for US readers who value productivity, organization, and smart financial planning. Whether you’re a seasoned saver, a budding entrepreneur, or someone simply looking to get a better handle on their monthly expenses, this template approach offers a structured yet flexible framework. It’s about creating a living document that serves as your personal financial organizer, offering insights and guiding your decisions, rather than dictating them. Think of it as your financial co-pilot, helping you navigate the complexities of income, spending, and savings with confidence.

The Power of Organized Financial Planning and Record-Keeping

In today’s fast-paced world, managing your finances can sometimes feel like a high-wire act without a net. Without a clear system, money can disappear faster than it arrives, leaving you wondering where it all went. This is precisely where the importance of organized financial planning and meticulous record-keeping comes into play. It provides the clarity and control necessary to make informed financial decisions.

Having a robust budgeting system acts as your financial compass, showing you exactly where you stand at any given moment. It helps you identify spending patterns, uncover areas where you might be overspending, and highlight opportunities for savings. This level of insight is invaluable, transforming abstract financial goals into concrete, achievable steps. By keeping a detailed record, you create an undeniable truth about your financial situation, stripping away assumptions and replacing them with facts.

Why a Structured Approach Matters: Key Benefits of the Template

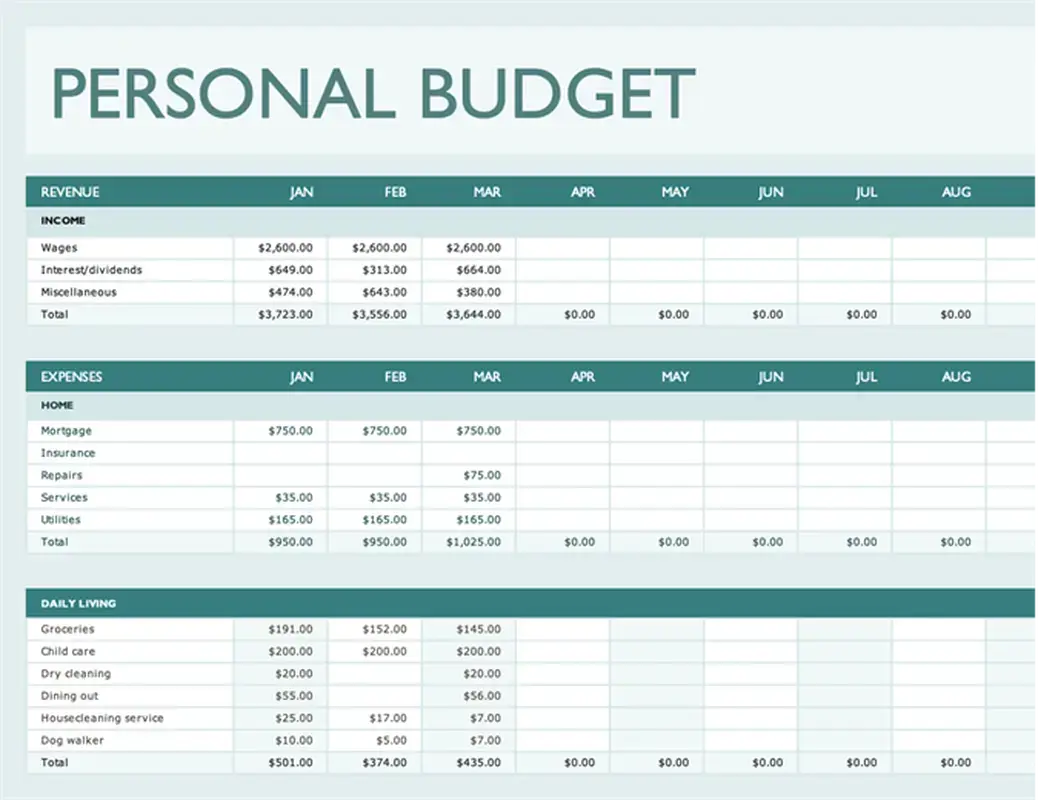

Embracing a structured template for your budgeting isn’t just about crunching numbers; it’s about unlocking a wealth of benefits that enhance your financial well-being. A well-designed personal budget template streamlines the entire process, making it less daunting and more accessible. It serves as your personal financial spreadsheet, providing a centralized place for all your monetary data.

One of the primary benefits is the instant visibility it offers into your cash flow. You can quickly see your income log versus your monthly expenses, allowing for immediate adjustments if needed. Furthermore, a structured layout acts as an effective expense tracker, preventing those "where did my money go?" moments. It empowers you to build a robust savings planner, allocate funds for specific goals, and even create a simple balance sheet to visualize your net worth. Ultimately, this approach reduces financial stress by replacing uncertainty with knowledge and empowers you to make proactive financial decisions.

Beyond Personal Finances: Adapting Your Template

While the term "personal budget template" naturally points to individual financial management, the underlying principles of this structured document are incredibly versatile. Its adaptability is one of its greatest strengths, allowing it to be repurposed for a wide array of planning and management scenarios. The core concept of tracking income against expenses, and allocating resources effectively, is universally applicable.

For small businesses, this sheet can easily transform into a basic cost management tool, tracking operational expenses, revenue streams, and projected profits. Event planners can adapt the layout to manage vendor payments, venue costs, and ticket sales, ensuring every aspect of an event stays within budget. Households can use this record as a comprehensive family financial organizer, managing shared bills, grocery budgets, and individual allowances. The beauty of this framework lies in its flexibility to be customized to nearly any scenario requiring diligent financial oversight and resource allocation.

When a Personal Budget Template Shines Brightest

A personal budget template truly comes into its own during specific life stages or financial endeavors where clarity and control are paramount. It’s not just a tool for when things are tight; it’s an empowering resource for every step of your financial journey.

Here are some examples of when using a personal budget template is most effective:

- Starting Your First Job: Establishing good financial habits early on is crucial. This sheet helps you understand your income versus expenses right from the start, making saving and debt management second nature.

- Saving for a Down Payment on a Home: A detailed savings planner within the template allows you to track progress toward a significant goal, adjusting your spending to maximize contributions.

- Planning a Major Life Event: Whether it’s a wedding, a significant vacation, or an educational pursuit, the template helps you allocate funds, track specific costs, and avoid unexpected financial burdens.

- Managing Debt: If you’re working to pay down student loans, credit card debt, or other liabilities, the planner provides a clear picture of how much you can realistically put towards payments each month.

- Starting a Small Business or Freelance Venture: Adapting the document to track startup costs, projected revenue, and ongoing operational expenses is vital for initial financial stability and growth.

- Preparing for Retirement: Long-term financial planning benefits immensely from seeing your current income and expenditure patterns, helping you project future savings and investment potential.

- Undergoing a Major Life Change: Divorce, career change, or a new baby can significantly alter your financial landscape. The record helps you quickly adapt your budget to new circumstances and prioritize new expenses.

- Simply Wanting More Financial Awareness: Even if you’re not facing a specific crisis or goal, using the spreadsheet consistently provides a profound understanding of your money habits, leading to greater financial freedom.

Designing for Success: Tips for Your Budget Document

The effectiveness of any financial organizer isn’t just in the numbers it contains, but also in how user-friendly and visually appealing it is. A well-designed budget document encourages consistent use and makes the process of financial tracking far more enjoyable. Whether you prefer a digital financial spreadsheet or a printed layout, thoughtful design and formatting are key.

For digital versions (like Google Sheets or Excel), prioritize clear categorization. Use color-coding for different income and expense types, which makes at-a-glance analysis much easier. Employ formulas to automate calculations for totals, remaining budget, and savings projections – this is where a financial spreadsheet truly shines. Include separate tabs for different months or years, an annual summary, and perhaps a dedicated savings planner or debt repayment tracker. For usability, ensure navigation is intuitive, with clear labels and perhaps a simple dashboard overview.

If you lean towards a print version, focus on a clean, uncluttered layout. Use legible fonts and ample white space to prevent information overload. Include clearly defined sections for income, fixed expenses, variable expenses, and savings goals. Consider a daily or weekly expense tracker section where you can jot down purchases on the go, making input into the main planner easier. Pre-labeling categories can save time, but also leave space for custom entries. A sturdy binder or folder to keep your records organized will also contribute to its long-term usability. Regardless of format, regularly review and update the record; a budget is a living document, not a static one.

Empowering Your Financial Future with This Essential Tool

Ultimately, embracing a comprehensive budgeting system is one of the most proactive steps you can take toward securing your financial future. This detailed record is far more than just a list of numbers; it’s a strategic plan for your money, a tool for growth, and a pathway to achieving your deepest financial aspirations. It demystifies where your money goes, clarifies where it comes from, and empowers you to direct it consciously towards your goals.

By consistently engaging with this financial organizer, you’ll find that it saves you precious time, reduces financial stress, and provides a powerful sense of control. It transforms the often-dreaded task of managing money into an empowering habit, allowing you to make intentional choices that align with your values. So, take the leap, design your ideal document, and start leveraging its incredible power to build the financially secure and productive life you envision.