We all work hard, and we deserve to enjoy the fruits of our labor. But sometimes, the line between enjoying life and overspending on leisure can get a little blurry. That’s where smart financial planning comes into play, especially when it comes to those fun, discretionary activities that bring so much joy but can also quietly drain our bank accounts. If you’re someone who values productivity, organization, and smart financial decisions, you know that intentionality is key to achieving your goals, even with your downtime.

Imagine having a clear picture of exactly what you’re spending on your hobbies, weekend trips, concerts, or even just dining out. No more end-of-month surprises or guilt over an impulse purchase. This isn’t about deprivation; it’s about empowerment. It’s about making conscious choices that align with your broader financial goals while still savoring life’s pleasures. This article will guide you through the invaluable benefits of using a dedicated recreational activity budget worksheet template, showing you how a little organization can lead to a lot more peace of mind and enjoyment.

The Importance of Organized Financial Planning for Clarity and Control

At its core, financial planning is about understanding where your money comes from and where it goes. Without a clear system, it’s easy to feel like you’re constantly playing catch-up, or worse, entirely out of control. Organized financial planning provides a flashlight in the dark, illuminating your spending patterns and giving you the power to steer your financial ship in the direction you choose. It transforms vague anxieties into actionable insights, helping you differentiate between wants and needs and prioritize accordingly.

An effective budgeting system isn’t just about cutting expenses; it’s about gaining clarity. When you track your income log and monthly expenses diligently, you build a comprehensive financial organizer that shows you your true cash flow. This level of detail allows you to make informed decisions about your discretionary spending, ensuring that your recreational pursuits don’t inadvertently derail your savings goals or impact your ability to cover essential costs. It’s the foundation upon which all smart money management is built, providing the peace of mind that comes from knowing exactly where you stand.

Key Benefits of Using Structured Templates for Budgeting

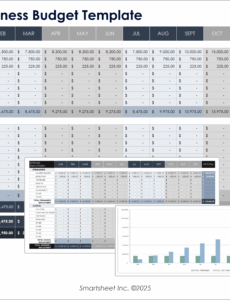

While some might prefer a free-form notebook or a mental tally, those who truly value organization understand the immense benefits of structured templates. A pre-designed financial spreadsheet offers consistency, clarity, and ease of use that ad-hoc methods simply can’t match. It removes the guesswork from setting up your budget, providing a logical framework for categorizing income and expenses without having to reinvent the wheel every time. This consistency is crucial for accurate tracking and comparison over time, allowing you to spot trends and make adjustments efficiently.

Structured templates, like a robust savings planner or an expense tracker, are powerful time-saving tools. They come equipped with designated sections and often include pre-built formulas (in digital versions) that automate calculations, reducing the risk of manual errors. This automation means less time spent crunching numbers and more time available for, well, your recreational activities! Furthermore, the visual clarity provided by a well-designed template makes it much easier to digest complex financial information, transforming what could be an overwhelming task into a straightforward, manageable process.

Adapting the Template for Various Purposes

While the name suggests a specific focus, the underlying principles of a recreational activity budget worksheet template are incredibly versatile. The core structure—tracking income, categorizing expenses, and calculating a net balance—is a fundamental building block for almost any financial record-keeping need. This adaptability means that once you master the use of this type of template, you gain a valuable skill applicable across many aspects of your organized life.

For personal finance, the template can be easily adjusted to become a comprehensive monthly budget, tracking everything from groceries to utilities, and even savings contributions. Small businesses can modify it into a basic cash flow statement or project-specific cost management tool, helping them monitor expenditures for events or marketing campaigns. Even for household management, it can be a lifesaver, allowing you to track shared expenses, plan for home improvement projects, or organize event planning for family gatherings. The beauty lies in its flexible framework, which can be tailored to suit a multitude of budgeting scenarios beyond just fun and games.

When a Recreational Activity Budget Worksheet Template is Most Effective

Having a dedicated financial tool specifically for discretionary spending can make a significant difference in your financial well-being and overall peace of mind. A recreational activity budget worksheet template isn’t just a good idea; it becomes an indispensable asset in several key scenarios where managing fun expenses can become complex. It’s particularly effective when you need a clear, defined structure to ensure your leisure activities don’t inadvertently impact your other financial goals.

Here are some examples of when using this template is most effective:

- Planning a Vacation or Trip: Before booking flights or accommodations, mapping out anticipated costs for travel, lodging, food, activities, and souvenirs ensures you stay within budget and avoid post-trip financial stress.

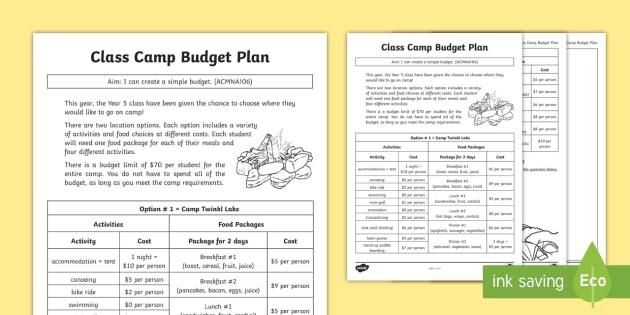

- Starting a New Hobby: Whether it’s photography, pottery, or golf, new hobbies often come with equipment costs, lessons, and ongoing supplies. The template helps you quantify these initial and recurring expenses.

- Managing Children’s Activities: From sports leagues and music lessons to summer camps and school trips, children’s recreational costs can add up quickly. This sheet helps parents keep a handle on these commitments.

- Saving for a Large Recreational Purchase: If you’re dreaming of a new bicycle, a boat, or a luxury experience, the planner allows you to set a savings goal and track your progress towards that specific recreational item.

- Annual Family Outings or Events: For regular events like holiday gatherings, theme park visits, or a yearly family reunion, the template can help you estimate and manage collective expenses.

- Controlling Monthly Discretionary Spending: For those who want to better track "fun money" spent on dining out, movies, concerts, or impulse buys throughout the month, this record provides immediate feedback.

- Evaluating the Cost-Effectiveness of Subscriptions: With the rise of streaming services, gym memberships, and various app subscriptions, the spreadsheet helps you list and review recurring recreational costs to ensure they still offer value.

Tips for Better Design, Formatting, and Usability

A template is only as good as its design and how easily it can be used. Whether you’re creating your own or customizing an existing one, thoughtful design, clear formatting, and a focus on usability will significantly enhance your experience with the document. Remember, the goal is to make financial tracking less of a chore and more of an intuitive process.

For design, prioritize clarity and logical flow. Use clear headings and labels for categories like "Income," "Fixed Expenses," and "Variable Recreational Expenses." Color-coding can be incredibly effective; for example, green for income, red for expenses, and yellow for savings goals. This visual distinction makes it easy to scan and understand your financial picture at a glance. Ensure there’s adequate white space to prevent the sheet from looking cluttered and overwhelming.

Regarding formatting, consistency is key. If you’re using a digital version, standardize your font, text size, and cell alignment. Use bolding for totals and subtotals to highlight important figures. For print versions, consider the layout to ensure it prints neatly on standard paper sizes, with sufficient margins and readable font sizes. Make sure any formulas in a spreadsheet are clearly visible or easily accessible for review, allowing you to understand how figures are calculated.

Usability is paramount. The planner should be simple to update and easy to understand, even after a few weeks or months. Include instructions or notes within the template if certain categories require specific input. If it’s a digital spreadsheet, implement simple conditional formatting to flag overspending or highlight when you’re hitting your savings targets. Regular review should be encouraged, so ensure the record has a section for notes or reflections on your spending habits. The more user-friendly the template, the more likely you are to stick with it and reap its benefits.

Embracing Financial Empowerment with Your Recreational Activity Budget

In our busy lives, taking the time to organize our finances, especially discretionary spending, might seem like an added burden. However, as we’ve explored, the practical value of a well-structured recreational activity budget worksheet template far outweighs the initial effort. It’s not just a document; it’s a powerful tool for clarity, control, and ultimately, a more enjoyable and less stressful life. By tracking your recreational expenses, you gain a sense of empowerment, knowing that every dollar spent aligns with your intentions and overall financial strategy.

This sheet acts as your personal financial compass, guiding you through the often-murky waters of discretionary spending. It frees you from the worry of overspending, allowing you to fully immerse yourself in your chosen activities without a nagging sense of guilt. The template saves you time, reduces stress, and transforms abstract financial goals into concrete, manageable steps. By consistently using this planner, you are not just budgeting; you are actively investing in your financial well-being and securing your ability to enjoy life’s pleasures responsibly.

So, embrace the power of organized finance. With this robust template, you’re not just tracking numbers; you’re cultivating a healthier relationship with your money, making smarter choices, and ultimately, setting yourself up for a life rich in both financial security and cherished recreational moments. Start using the template today and experience the profound peace of mind that comes from being truly in control of your financial destiny.