Organizing a school farewell party can be an incredibly rewarding experience, celebrating milestones and creating lasting memories for students, teachers, and parents alike. However, let’s be real: behind every memorable event is a whole lot of planning, and often, a surprising amount of financial coordination. Whether it’s a kindergarten graduation, a middle school send-off, or the much-anticipated high school prom after-party, managing the money involved can quickly become a stressful juggling act if you don’t have a clear system in place.

That’s precisely where a robust framework like a school farewell party budget worksheet template comes into play. It’s not just a fancy name for a list of expenses; it’s a proactive tool designed to empower anyone involved in event planning – from a diligent parent volunteer to a school committee member – to approach financial management with clarity, confidence, and control. This document serves as your financial roadmap, ensuring that every dollar spent is accounted for, contributions are tracked, and the party lives up to expectations without anyone ending up out of pocket or bewildered by vague numbers.

The Importance of Organized Financial Planning and Record-Keeping for Clarity and Control

Think of financial planning and meticulous record-keeping as the invisible backbone of any successful endeavor, especially when multiple people are contributing or benefiting. Without a structured approach, you’re essentially navigating uncharted waters without a compass. This often leads to unnecessary stress, awkward conversations about who paid for what, and the very real risk of overspending or, conversely, underspending on crucial elements. An organized expense tracker isn’t just about preventing financial mishaps; it’s about establishing trust, promoting transparency, and giving everyone involved a clear overview of the financial landscape.

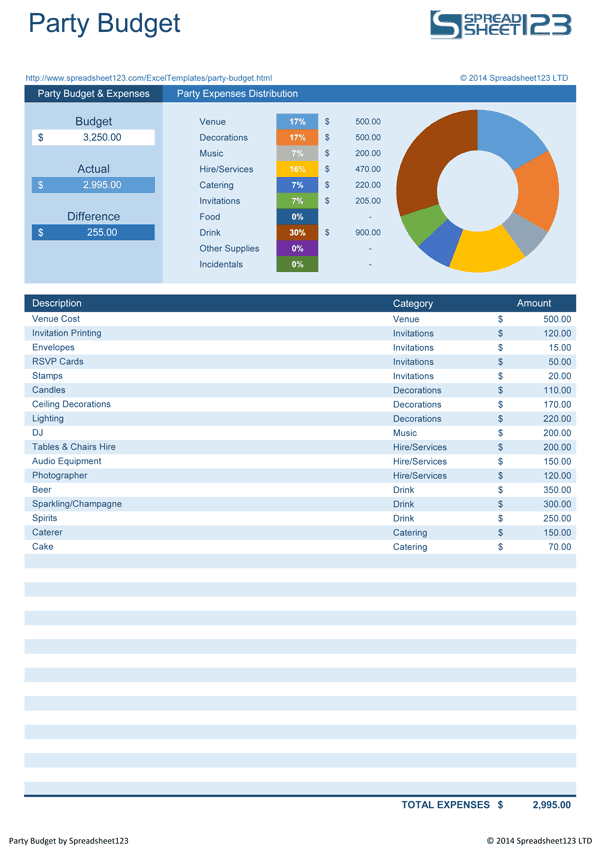

A well-maintained financial spreadsheet transforms ambiguity into clarity. It allows you to track not just what you’ve spent, but also what you need to spend, what funds are coming in, and your overall financial health for the event. This proactive approach helps in making informed decisions, such as whether there’s room for that extra dessert bar or if a more cost-effective decor option is necessary. It’s a core component of effective cost management, ensuring that every penny contributes to the desired outcome. By logging every transaction, you build a comprehensive record that serves as both an income log and an expense tracker, offering peace of mind and demonstrating responsible financial stewardship.

Key Benefits of Using Structured Templates, Planners, or Spreadsheets for Budgeting

In a world brimming with digital tools and organizational hacks, the humble budget template stands out as a productivity powerhouse. It streamlines a process that can often feel overwhelming, offering a pre-defined structure that anticipates common expenses and revenue streams. Instead of staring at a blank page and wondering where to start, a well-designed template provides categories for everything from venue rental and catering to decorations, entertainment, and miscellaneous costs. This consistency saves invaluable time, allowing organizers to focus on the creative aspects of the party rather than wrestling with financial organization from scratch.

Beyond saving time, using a structured planner significantly reduces the likelihood of errors and oversight. With formulas pre-built into digital versions, calculations are automated, minimizing manual entry mistakes. This financial organizer also acts as a central repository for all monetary information, making it easy to share with other committee members, obtain approvals, and maintain accountability. When everyone is looking at the same clear data, decision-making becomes collaborative and efficient. It’s a fundamental part of any robust budgeting system, providing a framework for a savings planner and a real-time balance sheet, ensuring that funds are allocated wisely and efficiently towards your party goals.

Adapting This Template for Various Purposes Beyond Farewell Parties

While the initial focus of a school farewell party budget worksheet template is tailored to a specific event, the underlying principles and structure are incredibly versatile. The beauty of a well-designed financial tool lies in its adaptability, making it a valuable asset far beyond its initial intention. The core components – income tracking, expense categorization, projected vs. actual costs, and a running balance – are universally applicable across numerous financial scenarios.

For instance, this same layout can be effortlessly adapted for personal finance management, transforming into a monthly expenses tracker that helps you monitor household spending, plan for major purchases, or stick to a savings goal. Small businesses can leverage its structure to manage project budgets, track client invoicing, and monitor operational costs, providing a simplified cash flow overview. Even larger-scale event planning, such as community festivals or charity galas, can benefit from the systematic approach of such a template, scaling up the categories and complexity as needed. The fundamental idea of segmenting financial data for clear oversight remains powerful, no matter the context.

When is a School Farewell Party Budget Worksheet Template Most Effective?

A robust financial planner like this really shines in scenarios where multiple expenses are involved, funds might be coming from various sources, and accountability is key. It’s not just for the grand, elaborate events; even smaller gatherings can benefit from this organized approach to prevent last-minute financial scrambling.

The school farewell party budget worksheet template is most effective in situations such as:

- Elementary School Graduation Parties: Managing parent contributions for cap and gown rentals, modest refreshments, and small keepsakes.

- Middle School Dance or Social Events: Tracking ticket sales, DJ costs, venue deposits, and snack budgets, often with parent-teacher association (PTA) involvement.

- High School Senior Prom After-Parties: Coordinating significant funds for venue hire, extensive catering, security, entertainment, and themed decorations, typically involving a dedicated committee.

- Teacher or Staff Appreciation Events: Budgeting for gifts, a luncheon, or a celebratory reception, often funded by parent donations or school funds.

- End-of-Season Sports Team Banquets: Organizing costs for team meals, awards, venue rental, and perhaps commemorative gifts, usually with contributions from team families.

- School Club Year-End Galas: Tracking membership dues, fundraising efforts, and specific event expenditures for clubs like debate teams, drama clubs, or STEM groups.

- Any collaborative event where shared financial responsibility and transparency are paramount: This includes fundraising events, field trip budgets, or school-wide carnivals where detailed financial oversight is non-negotiable.

Tips for Better Design, Formatting, and Usability (Print & Digital)

Creating a truly effective budget document goes beyond merely listing categories; its design and usability are paramount for long-term adherence and clarity. Whether you prefer a physical printout or a digital spreadsheet, thoughtful formatting significantly enhances its practical value.

For both print and digital versions, ensure clear and consistent labeling for all categories, columns, and rows. Use a readable font and maintain a consistent color scheme if you’re using one for visual grouping. In digital versions, leverage the power of formulas: sum functions for totals, average functions for per-person costs, and conditional formatting to highlight over-budget items or approaching deadlines. Always include a section for "Notes" or "Comments" where specific details, vendor contact information, or receipt numbers can be logged. This space is invaluable for future reference or audit.

When designing for digital use, consider adding dropdown menus for common categories or payment methods to streamline data entry. Protect formulas to prevent accidental deletion and set up easy sharing permissions for collaborative efforts. Include an "Income Log" and an "Expense Tracker" on separate tabs or clearly delineated sections, along with a "Summary" tab that automatically pulls data for a quick overview. For print versions, ensure sufficient white space for readability and manual annotations. Design with clear margins, use larger font sizes, and perhaps include checkboxes for completed tasks. Always include space for signatures if financial approvals are required, and provide a clear "Date Created" and "Last Updated" field to manage document versions effectively. A well-organized spreadsheet acts as a comprehensive budgeting system, making financial navigation intuitive and stress-free.

Embracing Financial Empowerment with Your Budget Worksheet

Ultimately, managing the finances for a school farewell party or any event doesn’t have to be a source of dread. By adopting a well-structured document, you’re not just creating a list of numbers; you’re building a powerful tool that offers clarity, peace of mind, and significant time savings. This diligent record-keeping transforms potential financial headaches into manageable tasks, allowing you to focus on what truly matters: creating a joyous and memorable occasion for everyone involved.

Think of this sheet as your financial co-pilot. It’s a proactive step towards smart financial planning, reducing stress by bringing order to what can often feel chaotic. No more guessing games, no more last-minute scrambling to figure out where funds went. With this planner, you’ll have a clear financial organizer at your fingertips, empowering you to make informed decisions and ensure that every celebration is as financially sound as it is fun.

So, embrace the power of organized budgeting. Whether you’re a seasoned event planner or tackling your first big school bash, integrating a reliable financial spreadsheet into your process will prove to be an invaluable asset, setting you up for success and celebration without the financial worry. It’s more than just a budget; it’s a testament to thoughtful planning and a commitment to transparent, efficient cost management.