Planning a wedding is an exhilarating journey, filled with dreams of beautiful venues, delicious food, and unforgettable moments. Yet, amidst the excitement of choosing flowers and tasting cakes, there’s a crucial, often overlooked, aspect that can make or break the experience: financial planning. Without a clear roadmap for your spending, the joyous path to "I do" can quickly become a stressful scramble, leading to overspending and unnecessary anxieties. This is where a robust financial tool becomes not just helpful, but essential.

Imagine navigating your wedding expenses with the clarity and control of a seasoned financial planner. That’s precisely the peace of mind a comprehensive wedding expense sheet template offers. It’s more than just a list of numbers; it’s your personal financial dashboard, designed to help you track every dollar, anticipate costs, and make informed decisions, ensuring your celebration reflects your vision without derailing your long-term financial goals. Whether you’re a meticulously organized individual or someone looking to finally conquer the complexities of budgeting, this template is designed to empower you to manage your wedding finances efficiently and confidently, turning potential stress into tangible success.

The Foundation of Financial Clarity: Why Organization Matters

In today’s fast-paced world, where financial decisions are constant, maintaining organized financial records isn’t just a good habit—it’s a critical skill. For major life events like a wedding, the stakes are even higher. A lack of organization can lead to hidden costs, missed payments, and a fuzzy understanding of your true financial position. This disarray doesn’t just impact your wallet; it can also affect your peace of mind, leading to arguments and regrets.

Think of organized financial planning as the bedrock of sound decision-making. When you have a clear expense tracker, you can see where your money is going, identify areas for potential savings, and ensure you’re staying within your allocated budget. This clarity provides a sense of control, reducing financial anxiety and empowering you to make choices that align with your values and priorities. From managing monthly expenses to building a robust savings planner, structured financial documents allow you to proactively manage your money rather than reactively chase it.

Unlocking the Power of Structured Templates: Beyond the Basics

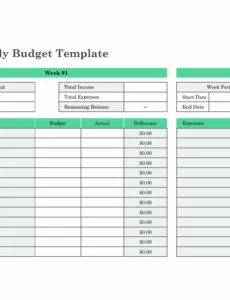

The true magic of using structured templates, planners, or financial spreadsheets lies in their ability to demystify complex financial data. They transform scattered receipts and vague estimates into a cohesive, actionable plan. Beyond simply listing income and expenditures, these tools offer a framework for understanding your financial health, helping you project future cash flow and monitor your overall balance sheet.

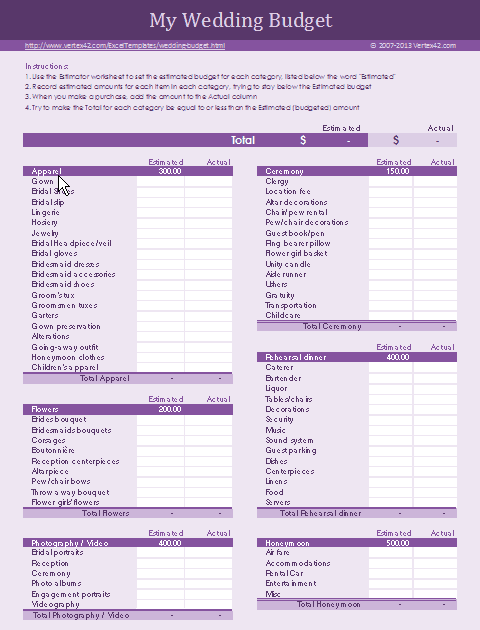

A well-designed template, for instance, doesn’t just track what you spend; it encourages thoughtful pre-planning. It prompts you to consider categories you might otherwise overlook, from postage for invitations to gratuities for vendors. Understanding how a wedding expense sheet template streamlines your efforts means recognizing its power as a dynamic budgeting system. It allows for easy adjustments as plans evolve, provides a historical record of your spending, and facilitates communication about finances with your partner or family.

Adapting Your Financial Blueprint: Versatility in Practice

While we’re focusing on its prowess for wedding planning, the fundamental principles behind a well-structured expense sheet are incredibly versatile. The same organizational logic that helps you manage a wedding budget can be seamlessly adapted for a myriad of other financial planning needs. This core design, emphasizing categories, actual vs. estimated costs, and payment tracking, proves invaluable across various domains.

For personal finance, it can transform into a detailed expense tracker for your household, helping you monitor monthly expenses and identify saving opportunities. Small businesses can repurpose the layout for project cost management, tracking expenditures against specific client contracts or internal initiatives. Event planners, naturally, find such a spreadsheet indispensable for managing multiple client events simultaneously. Even for general household management, from tracking home improvement costs to planning a major vacation, the underlying structure of a good financial organizer promotes clarity and control, making it a powerful, adaptable tool for virtually any cost management scenario.

When a Wedding Expense Sheet Template Shines Brightest

A specialized tool like a wedding expense sheet template isn’t just a good idea; it’s often a necessary one, especially during certain phases of the planning process or under specific circumstances. Its structure helps you navigate common pitfalls and ensures you maintain financial stability throughout.

Here are some examples of when using a wedding expense sheet template is most effective:

- Early Planning Stages: Right after getting engaged, before any contracts are signed. This allows you to set a realistic overall budget and allocate funds to major categories like venue, catering, and attire.

- Vendor Sourcing and Negotiations: As you research different vendors, the sheet helps you compare quotes, track down payment requirements, and note final agreed-upon prices, ensuring no detail is overlooked.

- Managing Multiple Payment Schedules: Weddings involve staggered payments—deposits, installment payments, final balances. The template ensures you never miss a due date, avoiding late fees or potential vendor issues.

- Tracking Hidden or Miscellaneous Costs: Many small expenses add up quickly (e.g., postage, tips, emergency kits, marriage license fees). The record provides dedicated categories for these "hidden" costs, preventing budget surprises.

- Post-Wedding Wrap-Up: After the big day, the document serves as a comprehensive record for reviewing actual expenditures against your initial budget, helping you understand where you excelled and where you might improve for future financial planning.

- When Family Contributions Are Involved: If various family members are contributing to different aspects, the planner can clearly track who is responsible for which costs, avoiding confusion and ensuring transparency.

- Budget Recalibration: If you decide to scale up or down certain aspects of the wedding, the spreadsheet allows you to quickly see the impact on your overall budget and make informed adjustments.

Designing for Success: Tips for an Intuitive Expense Sheet

The effectiveness of any financial tool, including your wedding expense sheet, hinges on its design and usability. Whether you prefer a digital financial spreadsheet or a printed version, thoughtful design ensures that the template remains a helpful asset, not a source of frustration. The goal is to create a financial organizer that is intuitive, easy to update, and provides immediate insights.

For a digital version, leverage the power of spreadsheet software. Use clear headings for categories like "Category," "Estimated Cost," "Actual Cost," "Vendor," "Payment Due Date," and "Paid (Y/N)." Implement conditional formatting to highlight overdue payments or categories that are over budget. Utilize formulas to automatically calculate totals, remaining budget, and variances between estimated and actual expenses. Consider creating separate tabs for different phases of planning or major categories like "Venue & Catering" and "Attire & Accessories." For visual clarity, employ color-coding for different payment statuses (e.g., red for overdue, yellow for pending, green for paid).

If you prefer a print version, focus on a clean, uncluttered layout. Use sufficient spacing between lines and columns for readability, making it easy to handwrite entries. Large, clear fonts are a must. Consider binding the printed sheets into a dedicated binder or planner for easy access and to keep all your financial documents in one place. Ensure there’s ample room for notes, such as contact information for vendors or specific payment instructions. Remember, the best design is one that encourages consistent use and reduces the mental friction of updating your financial record, making your cost management efforts feel less like a chore and more like an empowering habit.

Ultimately, whether digital or physical, aim for a design that minimizes manual effort while maximizing insight. An effective spreadsheet or printed layout should instantly tell you where you stand financially, empowering you to make timely decisions and manage your cash flow with confidence.

The journey to your wedding day is unique, but the need for solid financial planning is universal. This comprehensive template isn’t just a tool; it’s a strategic partner, transforming the often-overwhelming task of budget management into a clear, controlled, and even enjoyable part of your planning process. By providing a structured framework, it empowers you to visualize your spending, track progress, and make confident decisions, ensuring your financial peace of mind matches the joy of your celebration.

Embracing this well-organized record for your wedding expenses is an investment in your peace of mind and your financial future. It liberates you from guesswork, minimizes stress, and allows you to focus on the truly important aspects of your big day: the love, the celebration, and the memories you’re creating. So, take control of your wedding finances, leverage the power of smart planning, and build a beautiful, stress-free path to "I do."