In the intricate landscape of modern business operations, clear and concise communication stands as a cornerstone of professionalism and efficiency. Navigating financial discrepancies, such as a returned check, requires not only prompt action but also a meticulously documented approach. This article introduces a critical resource: the returned check letter template, a structured framework designed to facilitate effective and formal notification in such sensitive situations.

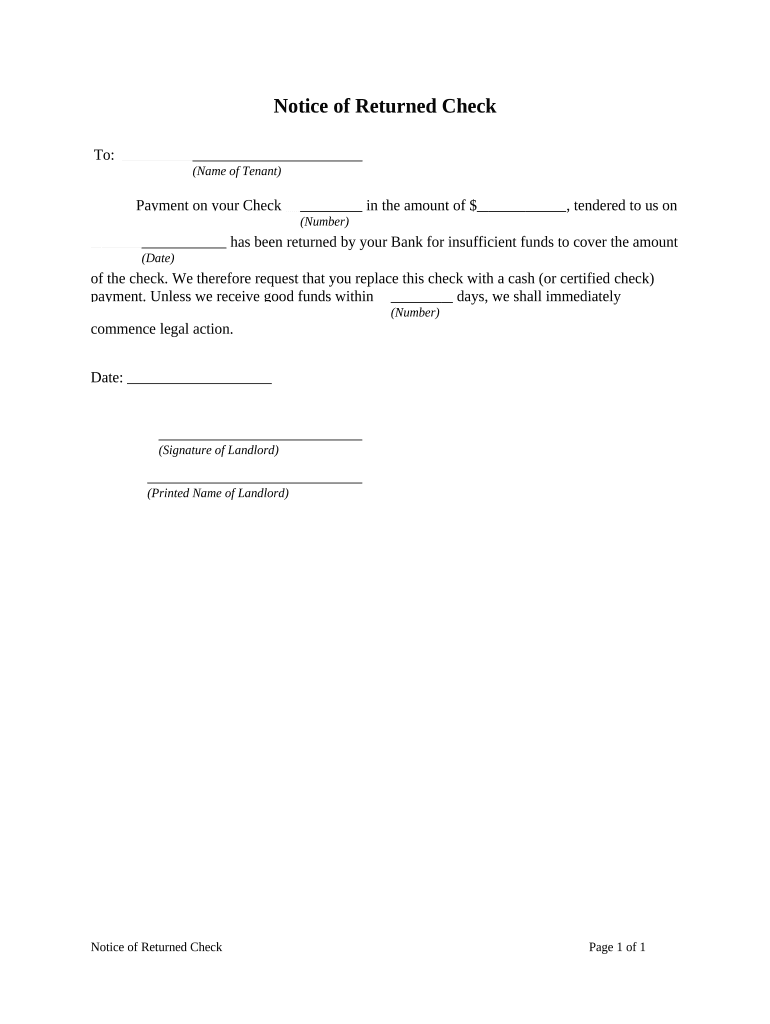

The primary purpose of a standardized returned check letter template is to provide businesses, financial institutions, and individuals with a reliable, pre-formatted means to inform a payee about a dishonored payment. Utilizing such a template ensures that all necessary information is conveyed accurately, promptly, and in a manner that upholds professional standards. This invaluable tool benefits anyone who needs to communicate an issue of non-payment due to insufficient funds, closed accounts, or other banking reasons, streamlining a process that could otherwise be fraught with ambiguity and potential legal complications.

The Indispensable Role of Written Communication in Business

Professional documentation forms the backbone of accountable and transparent operations in any sector. Written communication, unlike its verbal counterpart, creates an official record, eliminating misunderstandings and providing a tangible reference for all parties involved. Whether it’s formal correspondence, a detailed business letter, or an internal memo, the act of putting information into writing lends it authority and permanence.

In legal and financial contexts, the importance of precise documentation cannot be overstated. Every interaction, especially those involving money, benefits from a clear, dated, and signed record. Such documentation serves as proof of communication, outlining expectations, obligations, and consequences, thereby mitigating risks and protecting the interests of all stakeholders. A well-crafted notice letter or written request acts as an official record, crucial for compliance and dispute resolution.

Key Benefits of Using a Structured Returned Check Letter Template

Implementing a structured returned check letter template offers numerous advantages that extend beyond mere notification. This type of letter helps maintain professionalism, ensuring that even under potentially difficult circumstances, communication remains respectful and clear. It projects an image of organized efficiency, reinforcing trust and credibility.

Consistency is another significant benefit. When all returned check notifications adhere to a uniform layout and tone, it establishes a predictable and reliable communication channel. This standardization minimizes the effort required to draft new correspondence for each instance, saving valuable time and resources. Furthermore, the clarity inherent in a well-designed message template reduces the likelihood of misinterpretation, ensuring the recipient fully understands the issue and the required corrective actions.

Customizing the Template for Diverse Communication Needs

While designed for a specific purpose, the underlying structure of this document is highly adaptable, making it a versatile tool for various formal notifications. The core principles of clear headings, factual content, and a professional closing can be applied to many different scenarios beyond just returned checks. This flexibility allows organizations to tailor the basic layout to suit specific internal policies or external communication requirements.

For example, the template’s framework can be customized for employment-related notifications, business requests, or other official records requiring a formal, structured approach. By modifying the specific content while retaining the professional communication style, businesses can create consistent documentation for various administrative tasks. This adaptability makes the template an excellent foundation for any written request or formal correspondence that demands precision and clarity.

Effective Scenarios for Utilizing a Returned Check Letter Template

The application of a returned check letter template is most effective in specific situations where immediate, unambiguous, and documented communication is paramount. Its structured nature ensures that critical information is consistently provided, leaving no room for doubt.

- Insufficient Funds (NSF): When a check is returned due to a lack of available funds in the payer’s account, this letter provides a formal notification, requesting immediate resolution and often outlining associated fees.

- Account Closed: If a check bounces because the account has been closed, the template helps formally inform the payer, seeking an alternative payment method and detailing any penalties.

- Stop Payment Order: While less common for returned checks, if a check is dishonored due to a stop payment, the template can be adapted to request clarification and alternative payment.

- Payment for Goods/Services: Businesses that receive returned checks for products sold or services rendered use this template to secure outstanding payments and inform customers of additional charges.

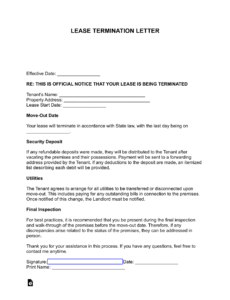

- Rent or Loan Payments: Landlords and lenders rely on this form to formally notify tenants or borrowers of a bounced payment, detailing late fees and the need for prompt re-payment to avoid further penalties.

- Legal Documentation: In cases where legal action may be considered for repeated non-payment, the consistent use of this correspondence provides an unbroken chain of formal notices, serving as crucial evidence.

Formatting, Tone, and Usability Guidelines

Effective communication hinges not only on what is said but also on how it is presented. The formatting of the template plays a crucial role in its readability and professional impact. For both print and digital versions, adherence to standard business letter formatting is essential.

Formatting Tips:

- Professional Header: Include the sender’s full contact information, the date, and the recipient’s contact information clearly at the top.

- Clear Subject Line: A concise subject line such as "Notification of Returned Check – [Invoice Number/Account Name]" immediately informs the recipient of the letter’s purpose.

- Structured Paragraphs: Keep paragraphs short (2-4 sentences) and focused, addressing one point at a time. Use bullet points for lists of fees or required actions to enhance readability.

- Bold Key Information: Bold important dates, amounts, and deadlines to draw the reader’s attention to critical details.

- Appropriate Spacing: Use single-spacing for paragraphs with double-spacing between paragraphs and sections to create visual breaks.

- Legible Font: Opt for professional and easy-to-read fonts like Arial, Calibri, or Times New Roman, typically in 10-12 point size.

Tone Guidelines:

- Formal and Objective: Maintain a formal and objective tone throughout the letter. Avoid accusatory or emotional language. The goal is to inform and seek resolution, not to provoke.

- Clear and Direct: Be direct about the issue, stating clearly that a check has been returned and why. Ambiguity can lead to further delays.

- Respectful: While firm about the need for resolution, always maintain a respectful tone. This preserves the business relationship where possible and reduces friction.

- Action-Oriented: Clearly state the required actions from the recipient, including the amount owed (original check amount plus any fees), payment deadlines, and acceptable payment methods.

Usability for Print and Digital Versions:

- Print Versatility: Ensure the letter prints cleanly on standard letter-sized paper, with adequate margins for signing and filing. A PDF version is ideal for print distribution.

- Digital Accessibility: For digital versions, ensure the document layout is accessible across various devices and email clients. Using standard file formats (like PDF or Word document) ensures compatibility. Embed all necessary information directly into the file, avoiding reliance on external links where possible for crucial details.

- Electronic Signatures: For digital correspondence, consider the use of secure electronic signatures to maintain the legal validity and professionalism of the file.

In conclusion, the strategic implementation of a well-crafted returned check letter template is more than just a procedural formality; it is an essential component of robust financial management and professional communication. This template serves as a consistent, clear, and legally defensible method for addressing non-payment issues, reinforcing accountability for both the sender and the recipient. Its structured approach ensures that every necessary detail is conveyed with precision and professionalism.

By standardizing this critical form of correspondence, businesses and individuals can significantly reduce administrative overhead, mitigate potential disputes, and maintain a reputation for meticulous operations. The value of this message template extends to establishing clear expectations, documenting financial occurrences, and facilitating prompt resolution. Ultimately, a reliable returned check letter template stands as an indispensable tool for fostering clarity and efficiency in all financial dealings.