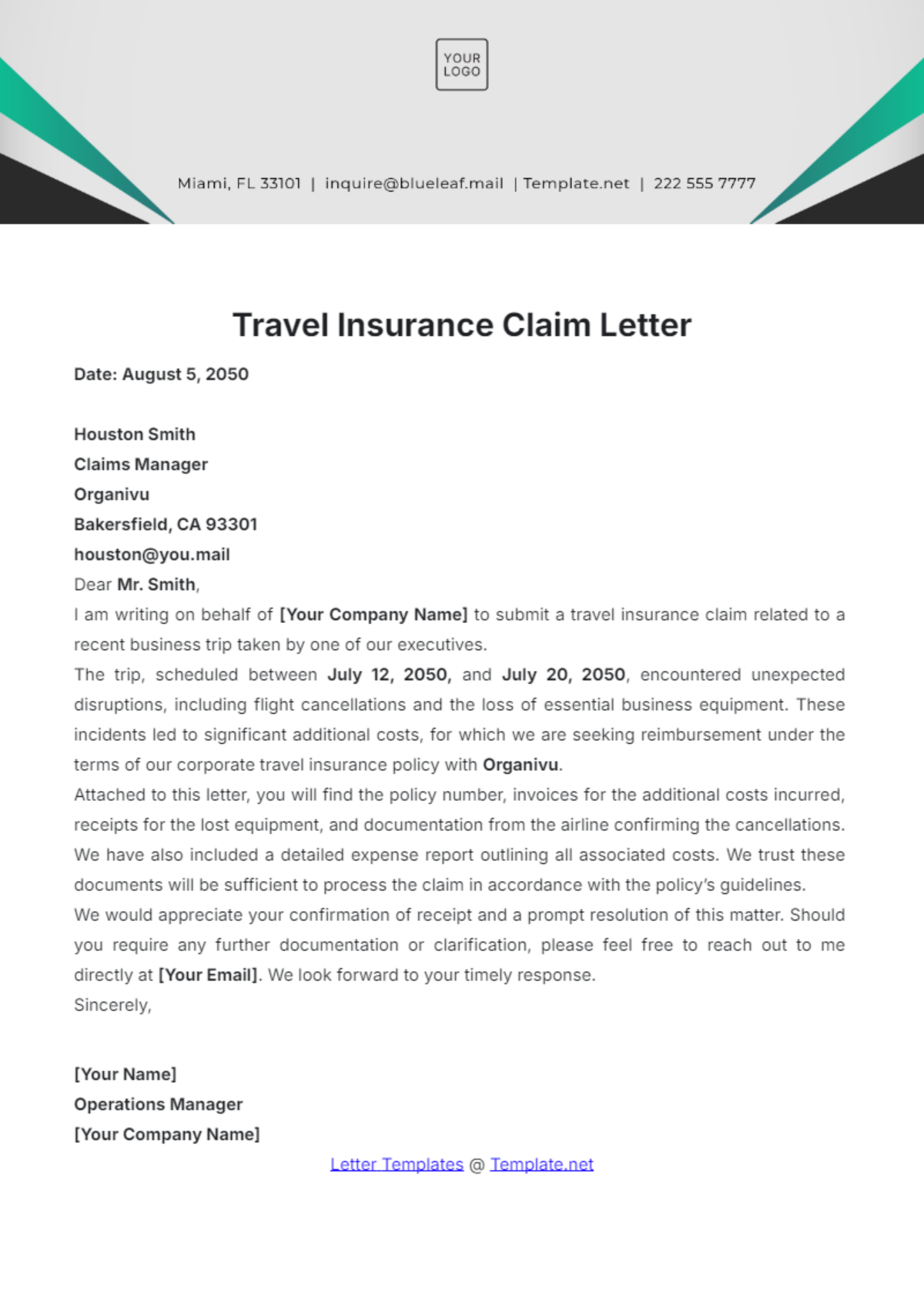

Navigating the complexities of post-travel incidents, particularly those requiring an insurance claim, can be a daunting experience. Precise and professional communication is paramount to ensure your claim is processed efficiently and accurately. This article introduces the utility and structure of a travel insurance claim letter template, a meticulously designed tool aimed at streamlining this crucial communication process. It serves as a foundational guide for individuals seeking to present their case clearly and comprehensively to insurance providers.

The primary purpose of utilizing a well-crafted travel insurance claim letter template is to establish a clear, documented record of your claim, outlining all pertinent details from the outset. This pre-formatted document benefits anyone needing to submit an insurance claim for travel-related issues, including lost luggage, medical emergencies abroad, trip cancellations, or delays. By providing a structured framework, it empowers claimants to communicate effectively, reducing potential misunderstandings and expediting the review process by the insurance company.

The Indispensable Role of Written Communication in Professional Documentation

In both business and personal realms, the importance of written communication cannot be overstated. It serves as a tangible record, offering clarity and accountability that verbal exchanges often lack. Professional documentation, in particular, underpins nearly all significant transactions and agreements, from legal contracts to HR directives. A well-composed letter or memo provides an authoritative statement, ensuring that intentions and facts are clearly articulated and preserved.

This commitment to formal correspondence is critical in situations requiring a formal request, notification, or dispute resolution. It establishes a verifiable timeline of events and communications, which can be invaluable in mitigating misunderstandings or resolving disagreements. Such documentation solidifies the communication, making it an official record that can be referenced by all parties involved, ensuring transparency and reducing ambiguity.

Key Benefits of Using Structured Templates for Travel Insurance Claims

Adopting a structured travel insurance claim letter template offers numerous advantages, fundamentally improving the efficiency and professionalism of your interactions with insurance providers. This approach ensures that all necessary information is consistently included, minimizing the back-and-forth typically associated with incomplete submissions. It fosters a level of professionalism that reflects positively on the claimant, signaling seriousness and attention to detail.

A standardized message template contributes significantly to maintaining consistency in communication. Each written request follows a similar document layout, which not only simplifies the drafting process for the sender but also streamlines the review process for the recipient. This consistency helps prevent the omission of critical details, a common pitfall in unstructured correspondence, thereby enhancing the clarity of the overall message. Utilizing such a layout allows for a clear, organized presentation of facts, significantly improving the likelihood of a swift and favorable resolution.

Customizing Your Template for Diverse Formal Communication Needs

While the core principles of formal communication remain constant, the specific content of official records must be tailored to its intended purpose. A versatile message template can be adapted for a wide array of scenarios beyond travel insurance claims, demonstrating its broad applicability in formal settings. This adaptability ensures that the underlying structure for professional communication can serve multiple functions, maintaining efficiency without sacrificing specificity.

For instance, this robust layout can be modified to serve as a cover letter for employment applications, a formal business letter detailing a proposal, or a notice letter for contractual obligations. Each adaptation requires specific adjustments to the body paragraphs, salutations, and enclosures, but the foundational elements of clarity, conciseness, and professionalism endure. The ability to customize this form ensures that it remains a powerful tool for various written requests, providing a consistent professional facade across all formal correspondence.

Effective Applications of the Claim Letter Template

The utility of using a structured template extends across numerous scenarios where clear, documented communication is essential. Its application ensures that your message is not only received but also understood and acted upon efficiently. Here are specific instances when utilizing the letter is most effective:

- Submitting a trip cancellation claim: Detailing the reason for cancellation, dates, booking references, and any non-refundable costs.

- Filing a claim for lost or damaged luggage: Including flight details, luggage tags, itemized lists of contents, and police reports or airline property irregularity reports.

- Reporting medical emergencies incurred abroad: Providing dates of treatment, medical reports, receipts for services, and contact information for medical providers.

- Claiming for trip delays or interruptions: Outlining the duration of the delay, reasons (if known), additional expenses incurred for accommodation or meals, and airline/transportation provider documentation.

- Requesting reimbursement for emergency evacuation: Supplying medical necessity documentation, transport receipts, and details of the initial incident.

- Disputing an initial claim denial: Clearly stating the grounds for dispute, referencing policy clauses, and attaching any new or previously overlooked supporting documentation.

- Formal inquiries about policy coverage or claim status: While not strictly a claim, using the template for such inquiries ensures a professional and documented interaction.

These examples underscore how a standardized document can significantly enhance the effectiveness of your communication, ensuring all critical information is presented clearly and concisely.

Formatting, Tone, and Usability Guidelines

Effective communication, whether digital or print, relies heavily on appropriate formatting and tone. The presentation of the document is as crucial as its content in conveying professionalism and seriousness. Adhering to established standards for business communication ensures that your message is not only legible but also commanding of respect and attention.

Formatting for Clarity and Professionalism

For both print and digital versions, consistency in formatting is key. Use a standard, easily readable font such as Arial or Times New Roman, in a size of 10-12 points. Maintain consistent margins (typically 1 inch on all sides) and clear paragraph breaks to enhance readability. Dates, contact information, and specific claim numbers should be prominently placed at the top of the letter. Utilize bullet points or numbered lists within the body of the letter when presenting multiple pieces of evidence or a sequence of events. This structured approach helps the reader quickly absorb complex information and maintains a clean, professional document layout.

Maintaining an Appropriate Tone

The tone of your formal correspondence should always be professional, polite, and objective. Even in situations involving frustration or disappointment, avoid emotional language or accusatory statements. Focus on presenting facts clearly and concisely. Your communication should be assertive but not aggressive, firm but respectful. A professional tone reinforces the seriousness of your written request and encourages a constructive response from the insurance provider. Remember that this communication is an official record, and its tone will reflect on your professionalism.

Ensuring Usability Across Platforms

When preparing the file for digital submission, ensure it is saved in a widely accessible format, such as PDF. This preserves the document’s layout and prevents unintended modifications. If submitting a print version, use high-quality paper and ensure all attachments are securely fastened and clearly referenced within the letter. For both digital and physical submissions, maintain a personal copy of the entire correspondence, including all attachments and proof of delivery. This practice safeguards your interests and provides an invaluable reference should any discrepancies or follow-ups be required.

Conclusion: The Enduring Value of a Structured Communication Tool

In an increasingly complex world where effective communication often dictates outcomes, the structured approach offered by a claim letter template proves invaluable. It is more than just a form; it is a strategic tool designed to facilitate clear, professional, and impactful formal correspondence. By providing a clear framework for articulating details and supporting evidence, this template significantly enhances the probability of a smooth and successful claim resolution.

Embracing this well-organized approach ensures that every interaction with your insurance provider is underpinned by clarity, consistency, and professionalism. It empowers individuals to take control of their communication, transforming potentially stressful claim processes into manageable, organized tasks. The enduring value of this document lies in its ability to instill confidence in the sender and clarity for the receiver, making it an indispensable asset in personal and business communication.