In numerous financial and administrative dealings, presenting verifiable documentation of one’s income is a non-negotiable requirement. Whether applying for a loan, securing a rental property, or confirming financial stability, a formal statement often serves as the cornerstone of such processes. The need for a clear, verifiable proof of income letter template becomes evident for both individuals seeking to demonstrate their financial standing and entities requiring such confirmation. This structured approach simplifies a frequently complex task, ensuring accuracy and professionalism.

This article explores the critical role of a well-designed proof of income letter template, highlighting its benefits for individuals, businesses, and financial institutions alike. It delves into how a standardized format not only streamlines administrative tasks but also reinforces credibility and clarity in essential communications. Understanding the proper construction and application of such a document is vital for navigating the modern financial landscape effectively.

The Imperative of Professional Written Communication

Professional written communication forms the bedrock of trust and accountability in both business and personal realms. Documents like formal correspondence, business letters, and official records carry significant weight, often serving as legal or administrative evidence. Their clarity, precision, and adherence to established formats are crucial for preventing misunderstandings and ensuring smooth transactions. In a world increasingly reliant on documented proof, poorly constructed communications can lead to delays, rejections, and even legal complications.

This emphasis on meticulous documentation extends to financial matters, where accuracy is paramount. An official record of income, precisely articulated and professionally presented, eliminates ambiguity and provides an undeniable factual basis. It reflects positively on the sender’s attention to detail and commitment to transparent dealings, setting a professional tone from the outset. Consequently, leveraging a reliable message template for sensitive financial information is not merely an option but a professional imperative.

Key Benefits of Using a Structured Proof Of Income Letter Template

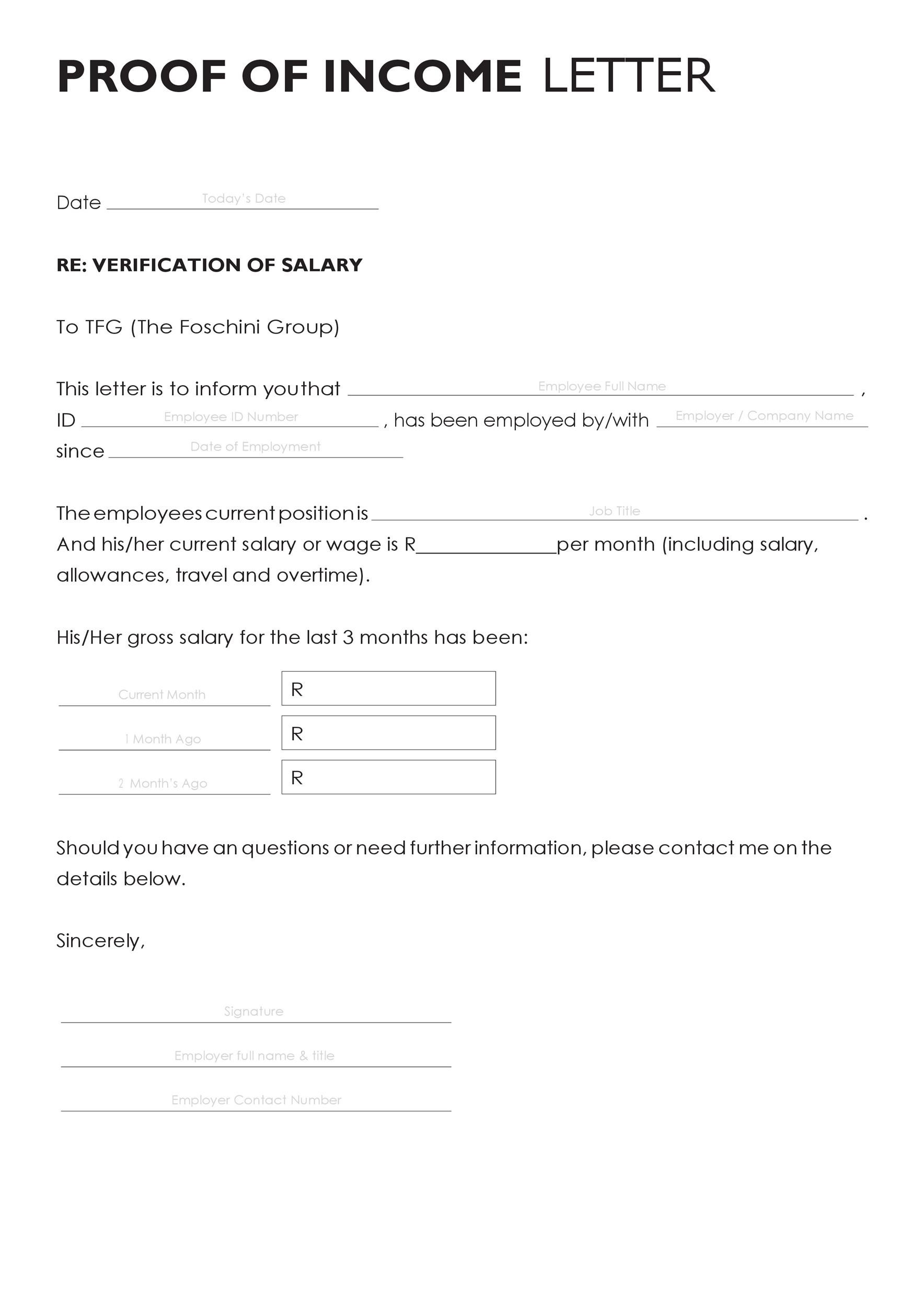

Employing a structured proof of income letter template offers a multitude of advantages that enhance professionalism, consistency, and clarity in communication. First and foremost, it ensures that all necessary information is consistently included, minimizing the risk of oversight or incomplete submissions. This adherence to a standard document layout guarantees that critical details like income figures, employment dates, and verification contacts are never omitted.

Furthermore, a standardized template projects an image of professionalism and credibility, which is invaluable in formal settings. It demonstrates an organized approach to financial documentation, instilling confidence in the recipient regarding the accuracy and validity of the information provided. Such consistency not only simplifies the review process for institutions but also serves as a robust official record for the sender. Ultimately, this approach saves time, reduces administrative burdens, and fosters more efficient exchanges of vital financial data.

Customizing the Document for Diverse Applications

The inherent flexibility of a well-designed template allows for significant customization to suit various purposes, from employment verification to complex business requests. While the core structure remains consistent, specific fields and supplementary information can be tailored to meet the unique demands of each scenario. This adaptability makes the document a versatile tool across a broad spectrum of administrative and financial requirements. Effective use of this form ensures that specific information is highlighted as needed, enhancing its utility.

For Employment Verification:

When employers issue a letter for current or former employees, the document typically verifies employment status, dates of employment, job title, and salary. Customization involves ensuring the company’s official letterhead is used and including the authorized signatory’s contact information. This professional communication serves as a direct affirmation of an individual’s work history and earnings.

For Self-Employed Individuals or Businesses:

Self-employed individuals or business owners may need to provide proof of income through accountant-verified statements, bank statements, or tax return summaries. Customizing this form involves integrating specific financial statements or declarations that illustrate consistent revenue over a defined period. The written request often requires a detailed breakdown of earnings and expenses, affirmed by a certified professional.

For Rental or Loan Applications:

Landlords and lenders frequently require a standardized format for income verification to expedite their application processes. Adapting the letter for these purposes means ensuring it aligns with the specific requirements of the application, such as providing monthly income, annual income, or details of other financial assets. This type of letter becomes a crucial element in demonstrating financial stability for significant investments.

For Government or Legal Submissions:

For applications involving government assistance, benefits, or legal cases, the documentation must adhere to strict regulatory guidelines. Customization here focuses on incorporating specific clauses, disclaimers, or appendices mandated by the relevant authority. This formal correspondence acts as a crucial piece of evidence in official proceedings, necessitating absolute accuracy and compliance.

Scenarios Where This Form Is Most Effective

Utilizing a well-structured message template for income verification proves particularly effective in a variety of common scenarios where reliable financial documentation is essential. This ensures that all necessary details are presented clearly and professionally, reducing potential delays or misunderstandings.

- Applying for a mortgage or personal loan: Lenders require definitive proof of income to assess repayment capacity and creditworthiness. This standardized documentation simplifies their verification process.

- Securing a new rental property: Landlords often request income verification to ensure prospective tenants can consistently meet rental obligations. A clear, concise letter streamlines the approval process.

- Qualifying for government assistance or benefits: Agencies mandate formal documentation to determine eligibility for various social welfare programs. The layout helps to present required information uniformly.

- Verifying income for educational scholarships or financial aid: Educational institutions and scholarship providers need to confirm financial need or capacity. This form provides a standardized method for verification.

- Supporting visa or immigration applications: Immigration authorities frequently demand proof of financial stability as part of the application process. The correspondence adds credibility to the applicant’s claims.

- Responding to legal requests for financial documentation: In legal proceedings, official income statements can be crucial evidence. A formal letter ensures compliance and legal soundness.

- Establishing creditworthiness with a new vendor: Businesses may require income verification from new clients or partners to assess their financial reliability for extended credit terms.

Formatting, Tone, and Usability Guidelines

Adhering to best practices in formatting, tone, and usability is paramount for any professional communication, especially an official income verification document. These guidelines ensure that the letter is not only accurate in its content but also effective in its presentation and easily accessible to all recipients. A well-crafted document layout significantly contributes to its overall impact.

Structure and Layout:

A standard business letter format should always be followed for this type of official record. This includes the sender’s and recipient’s full addresses, the date, a clear salutation, the body of the letter, a professional closing, and space for a signature. Clear headings and subheadings within the letter enhance readability, breaking down complex information into digestible sections. Using a professional, legible font (e.g., Times New Roman, Arial, Calibri) in an appropriate size (10-12pt) ensures clarity and ease of reading. The overall document layout should convey professionalism and organization.

Content and Tone:

The content must be concise, factual, and objective, avoiding any subjective language or emotional appeals. The tone should remain consistently formal and professional throughout the entire correspondence. Avoid jargon where possible, or explain it clearly if its use is unavoidable. All pertinent details, such as exact income figures, employment dates, and contact information for verification, must be included accurately without excessive embellishment. The purpose of the letter is to inform, not to persuade.

Print vs. Digital Considerations:

For printed versions, using high-quality paper reflects the importance of the document. An original, wet signature is often required for legal validity. When distributed digitally, the file should preferably be in a non-editable format, such as PDF, to maintain its integrity and prevent unauthorized alterations. If electronic signatures are used, ensure they comply with relevant legal standards and are securely implemented. Accessibility across different devices and operating systems should also be considered, ensuring the message template renders correctly regardless of the platform.

Ensuring Accuracy and Compliance:

Before finalizing and dispatching the letter, a thorough review for accuracy is essential. Double-check all figures, dates, names, and addresses. It is also crucial to be mindful of privacy regulations, such as GDPR or state-specific data protection laws, and obtain any necessary consent before sharing personal financial information. The integrity of the information presented is critical for the credibility and legal standing of the document.

Ultimately, leveraging a well-designed proof of income letter template is more than a mere convenience; it is an indispensable component of effective business communication and personal financial management. This message template ensures that vital financial details are conveyed with precision, professionalism, and consistency, significantly streamlining interactions with lenders, landlords, and various administrative bodies. Its structured approach minimizes ambiguity and bolsters the credibility of the information presented, serving as a reliable official record.

By adopting a standardized approach, individuals and organizations can navigate complex verification processes with greater ease and confidence. The value of a meticulously prepared proof of income letter template lies in its ability to facilitate transparent, efficient, and professional exchanges, safeguarding interests and fostering trust in all financial dealings. This reliable file simplifies an often daunting task, allowing for clear and unhindered communication of crucial financial status.