In the intricate world of finance, legal obligations, and business transactions, clear and unambiguous communication is paramount. Whether you are an individual navigating personal financial matters, a small business owner managing accounts receivable, or a legal professional gathering documentation, the need for precise communication regarding financial obligations is constant. A well-crafted proof of debt letter serves as a critical instrument in this landscape, providing a formal, written record of an outstanding financial obligation or a request for its validation.

This article explores the utility and structure of a standardized framework for such correspondence. It is designed for anyone who requires a reliable method to formally document, request, or confirm a debt, offering a professional and organized approach to what can often be a sensitive or complex issue. By leveraging a structured approach, individuals and organizations can ensure their financial communications are clear, legally sound, and consistently professional, fostering clarity and mitigating potential disputes.

The Importance of Written Communication and Professional Documentation

The bedrock of effective business operations and personal financial management lies in the quality of its documentation. Written communication, especially concerning financial liabilities, transcends verbal agreements by providing an immutable record. This formal correspondence serves as tangible evidence of agreements, requests, and acknowledgments, offering a safeguard against misunderstandings and discrepancies that can arise from verbal exchanges.

Professional documentation, such as official records and structured letters, establishes a credible and authoritative tone. It signals to all parties involved that the matter is being handled with the seriousness and diligence it deserves. In disputes, these documented exchanges become invaluable, often serving as the primary evidence in legal or mediation proceedings. The absence of such precise, professional communication can lead to ambiguities, protracted negotiations, and potentially adverse financial or legal outcomes.

Key Benefits of Using Structured Templates for Proof Of Debt Letter Template

The adoption of a structured template for a proof of debt letter offers a multitude of advantages, significantly streamlining the process of financial communication. Firstly, it ensures consistency across all outgoing correspondence. This consistency not only reinforces an organization’s professionalism but also helps to maintain a uniform brand image, even in sensitive financial interactions.

Secondly, a well-designed template promotes clarity and completeness. By providing predefined sections for critical information such as debtor and creditor details, the exact amount owed, the nature of the debt, and relevant dates, it minimizes the chances of omitting vital information. This structured approach helps in creating a comprehensive business letter that is easy to understand and hard to misinterpret. Finally, utilizing a proof of debt letter template saves considerable time and resources. Rather than drafting each letter from scratch, users can quickly populate the standardized fields, reducing drafting errors and accelerating the communication process, thereby enhancing overall operational efficiency.

Customizing the Template for Various Purposes

The inherent flexibility of a robust communication template allows it to be adapted for a diverse range of scenarios beyond its primary function. While the core objective of a proof of debt letter template remains constant—to formally address a financial obligation—its specific application can vary widely depending on the context. This adaptability makes it an invaluable tool for both individuals and corporations alike.

For instance, in an employment setting, this form might be customized to confirm the repayment schedule for a company loan issued to an employee or to formally document an outstanding advance. In a broader business context, it could be tailored for business-to-business debt confirmations, formal requests for itemized statements from vendors, or in a preliminary stage of a dispute resolution process. It serves as a potent tool for various types of written requests, from simply seeking validation of a debt to formally disputing an amount or a charge. Furthermore, the layout can be modified to serve as a notice letter, informing a debtor of an impending deadline or the initiation of collection efforts, ensuring all formal notifications are delivered with professionalism and clarity.

Examples of When Using a Proof Of Debt Letter Template is Most Effective

The strategic application of a proof of debt letter template can significantly enhance various financial and legal processes. Its formal nature and structured presentation are particularly effective in situations where clarity, official record-keeping, and legal defensibility are paramount. Below are several key scenarios where leveraging such a template is highly beneficial:

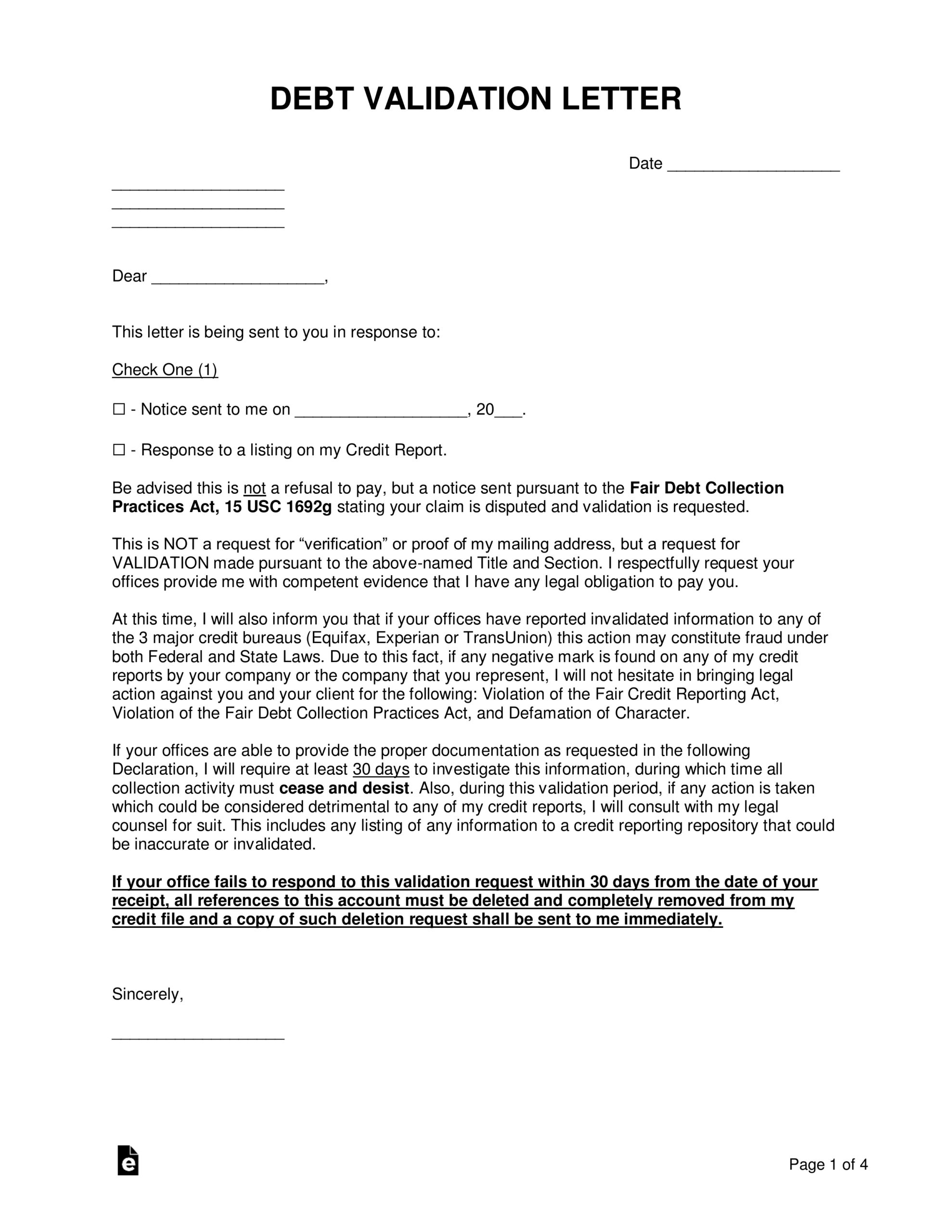

- Requesting Debt Validation: When a debt collector contacts an individual or business about an outstanding amount, a proof of debt letter serves as the formal written request to validate the debt. This legally mandated process ensures that the collector provides detailed information about the debt, including the original creditor, the amount owed, and proof that the debt belongs to the recipient.

- Confirming Outstanding Balances: Before making a significant payment or settling a debt, using this correspondence to confirm the exact outstanding balance, including any accrued interest or fees, ensures that both parties agree on the final figure, preventing future discrepancies.

- Disputing Debt Accuracy: If an individual or entity believes a debt is inaccurate, has already been paid, or does not belong to them, the template provides a formal mechanism to dispute the debt. This creates an official record of the dispute initiation, which is crucial for consumer protection and legal recourse.

- Providing Evidence in Legal Proceedings: In cases involving bankruptcy, civil lawsuits, or estate settlements, an official request or statement regarding a debt is essential documentation. The formal structure of the letter ensures it meets the criteria for evidence.

- Formal Demand for Payment: Before escalating to legal action, a business or individual can use the layout as a pre-litigation formal demand letter, clearly stating the amount due, the due date, and the potential consequences of non-payment.

- Documenting Loan Repayment Schedules: For private loans between individuals or non-institutional lending, a formal written confirmation of the agreed-upon repayment schedule and outstanding balance provides clear terms for all parties.

- Audit Confirmation: Businesses often require external confirmation of their outstanding debts and receivables for audit purposes. This form can be adapted to facilitate these requests, ensuring compliance and accuracy in financial reporting.

- Settlement Agreements: When negotiating a debt settlement, the terms and the final agreed-upon balance can be formally documented using the template, providing clear proof of the settlement terms once finalized.

Tips for Formatting, Tone, and Usability

To maximize the effectiveness of any professional correspondence, particular attention must be paid to its formatting, tone, and overall usability. When constructing a letter concerning financial obligations, these elements are not merely aesthetic preferences but fundamental components that reinforce its authority and clarity.

Formatting: Always adhere to a standard business letter format. This includes the sender’s and recipient’s contact information, the date, a clear subject line, a formal salutation, well-structured paragraphs, and a professional closing. For the body, utilize clear headings and concise paragraphs, ideally 2-4 sentences each, to break down information into digestible segments. Use professional, legible fonts (e.g., Times New Roman, Arial, Calibri) and ensure adequate spacing. When preparing the letter for print, use high-quality paper and ensure signatures are original, not digital copies unless legally specified. For digital versions, save the file as a PDF to preserve its layout and prevent unauthorized alterations, ensuring accessibility across various platforms.

Tone: The tone of the letter must be consistently formal, objective, and respectful. Avoid any language that could be perceived as accusatory, emotional, or confrontational. The primary goal is to communicate facts clearly and concisely. Maintain a professional demeanor throughout, even if the situation is contentious. Strive for neutrality, focusing on the details of the debt, relevant dates, and the specific action being requested or confirmed. This professional tone lends credibility and reduces the likelihood of escalating disputes unnecessarily.

Usability: A highly usable letter is one that is easy to read, understand, and act upon. Ensure a logical flow of information, starting with the most critical details and progressing to supporting information. Every sentence should contribute to the letter’s purpose. If the letter requires a response or specific action, include a clear call to action, specifying what is expected, by when, and how. Provide precise contact information for any follow-up questions. The objective is to make the entire message template as straightforward as possible, leaving no room for ambiguity regarding the debt or the required next steps.

In conclusion, the strategic use of a predefined structure for communicating financial obligations offers undeniable advantages in clarity, professionalism, and legal defensibility. This powerful tool serves as a reliable framework for managing sensitive financial interactions, ensuring that every message is conveyed with precision and authority. By adhering to best practices in formatting, tone, and usability, this correspondence becomes more than just a piece of paper; it transforms into a testament to diligent record-keeping and effective business communication.

Ultimately, whether you are confirming an outstanding balance, disputing an inaccurate charge, or providing evidence in a formal proceeding, leveraging a well-executed official record enhances your communication efficacy. It underscores your commitment to transparent and professional interactions, solidifying your position and safeguarding your interests in the complex landscape of financial obligations.