Planning an office party can feel like juggling flaming torches while riding a unicycle – exciting, potentially dazzling, but also fraught with the risk of a fiery financial mishap. Whether it’s the annual holiday bash, a milestone celebration, or a casual team-building get-together, the financial logistics can quickly become overwhelming. Without a clear plan, expenses can balloon, leading to stress, awkward conversations, and a post-party budget hangover that no amount of coffee can cure.

That’s precisely where a robust framework like an office party budget worksheet template comes into play. It’s not just about tracking numbers; it’s about gaining clarity, exerting control, and ensuring your team’s celebratory efforts are remembered for the good times, not the overspending. This essential tool is designed for anyone tasked with event planning, from HR professionals and team leads to dedicated office managers and small business owners, providing a clear roadmap to financial success for any corporate festivity.

The Undeniable Value of Organized Financial Planning

Think about the last time you embarked on a significant project without a plan. Chances are, it felt chaotic, inefficient, and possibly more expensive than it needed to be. The same principle applies, perhaps even more so, to financial endeavors. Organized financial planning isn’t just a nice-to-have; it’s a fundamental requirement for clarity, control, and ultimately, peace of mind.

When you meticulously record your anticipated and actual expenses, you transform vague estimates into actionable data. This structured approach helps prevent surprises, highlights potential areas for cost savings, and ensures accountability for every dollar spent. Without proper record-keeping, even a seemingly small event can spiral into an unmanageable financial headache, eroding trust and causing unnecessary stress within an organization.

Key Benefits of Structured Templates and Spreadsheets for Budgeting

Why bother with a template when a simple notepad or mental tally might seem easier? The answer lies in the profound benefits that structured templates, planners, or financial spreadsheets offer. They bring consistency and accuracy to your financial management, transforming a daunting task into a manageable process.

Firstly, a well-designed template provides a standardized format. This means everyone involved in the budgeting process speaks the same financial language, reducing confusion and miscommunication. It acts as a comprehensive expense tracker, ensuring no category is overlooked and every penny has a place.

Secondly, these layouts are inherently time-saving. Instead of reinventing the wheel for each event, you start with a proven framework. Formulas can be pre-built, categories pre-defined, and even vendor information can be templated for quick access. This efficiency allows you to focus more on the creative aspects of party planning and less on the administrative burden.

Moreover, a good budgeting system enhances decision-making. With all financial data laid out clearly, you can easily compare costs, assess the impact of different choices, and make informed decisions that align with your overall financial goals. It empowers you to be a proactive cost manager rather than a reactive one, ensuring your spending aligns with your values and resources, much like a meticulous savings planner for a long-term goal.

Adapting This Template for Various Financial Pursuits

While the name might suggest a specific use, the underlying principles of this template are universally applicable. The core concept of categorizing income and expenses, tracking actuals against estimates, and maintaining a clear financial record is invaluable across many aspects of life and business.

For personal finance, you can easily adapt this structure into a robust monthly expenses tracker or an income log, helping you visualize your cash flow and build a stronger balance sheet. Small businesses can leverage the same layout to manage project budgets, marketing campaign costs, or even annual operational expenses, turning it into a dedicated financial spreadsheet for their operations.

Event planners, whether professional or amateur, will find the format indispensable for weddings, fundraisers, or even large family gatherings. Household management can also benefit immensely, using a similar template to track groceries, utilities, and discretionary spending, ensuring financial harmony at home. The flexibility of this record-keeping approach makes it a truly versatile financial organizer.

When an Office Party Budget Worksheet Template is Most Effective

While versatile, there are specific scenarios where an office party budget worksheet template truly shines, transforming potential financial chaos into an orderly, well-managed event. It’s particularly effective when precision, accountability, and clear communication are paramount.

Here are some examples of when leveraging this specific template is most effective:

- Annual Holiday Parties: These often involve multiple departments, significant spending, and a need for clear budget allocations to avoid overruns and ensure fairness.

- Client Appreciation Events: When hosting clients, maintaining a professional image includes smart financial management, making this sheet crucial for tracking catering, venue, and entertainment costs.

- Company Milestones (e.g., Anniversaries, Retirements): These events often require detailed planning for specific activities, gifts, and catering, where meticulous tracking helps honor the occasion without financial strain.

- Team Building Retreats or Off-site Meetings: Beyond just the fun, these events incur travel, accommodation, activity, and meal costs. The planner helps consolidate all these varied expenses into one coherent view.

- Product Launch Events: Marketing, venue, decor, and PR expenses can quickly accumulate. This document provides a robust framework to manage the significant investment required for a successful launch.

- Fundraisers or Charity Galas: For non-profits, every dollar counts. The template assists in tracking donations, sponsorship income, and event expenditures to maximize net proceeds and ensure transparency.

Tips for Better Design, Formatting, and Usability

A template is only as good as its design and ease of use. Whether you’re creating a print-ready version or a dynamic digital spreadsheet, thoughtful formatting significantly enhances its practical value and ensures accurate data entry. A well-designed sheet is intuitive, minimizing errors and maximizing efficiency.

For Digital Versions (e.g., Excel, Google Sheets):

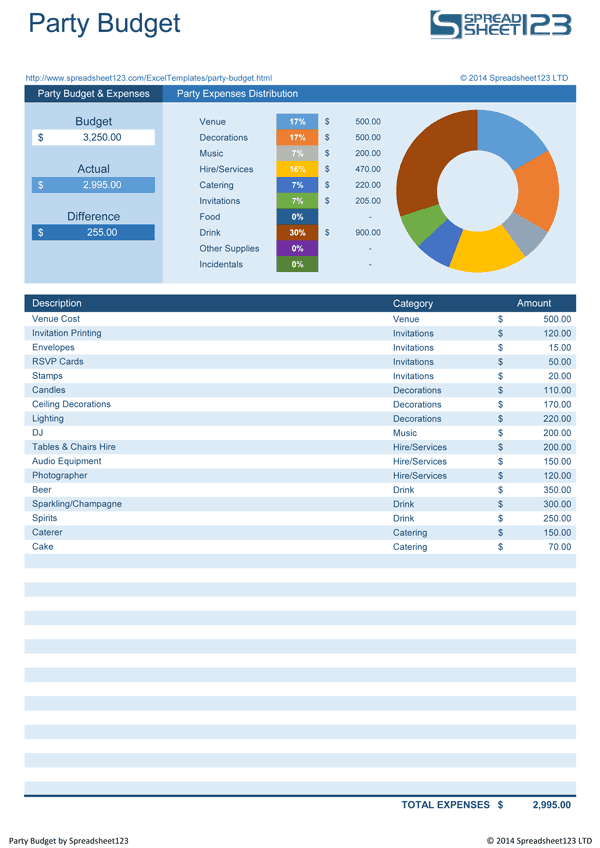

- Use Clear Headings and Categories: Group similar expenses (e.g., “Venue,” “Catering,” “Entertainment”). Use sub-categories for more detail (e.g., under “Catering”: “Food,” “Beverages,” “Service Staff”).

- Implement Formulas: Automate calculations for totals, remaining budget, and percentage spent. This reduces manual errors and provides real-time insights into your cash flow.

- Conditional Formatting: Use color-coding to highlight over-budget categories or approaching deadlines. For instance, cells showing an overspend could turn red.

- Data Validation: Create dropdown menus for common entries (e.g., vendor names, payment methods) to ensure consistency and speed up data entry.

- Add a Summary Tab: Dedicate a separate tab for a high-level overview, showing total budget, total spent, and remaining funds at a glance.

- Include a “Notes” Column: Provide space for comments, reasons for variances, or reminders for follow-up actions. This context is invaluable for future planning.

For Print Versions (or Digital Designed for Print):

- Ample Writing Space: Ensure lines and boxes are large enough for legible handwriting, especially if multiple people will be filling it out.

- Logical Flow: Arrange sections in a sequence that matches the natural progression of event planning, from initial booking fees to final cleanup costs.

- Consistent Layout: Use uniform fonts, sizes, and spacing for a professional and easy-to-read appearance.

- Checkboxes for Tasks: Add small checkboxes next to key items (e.g., “Invoice Paid,” “Confirmation Received”) to help manage tasks alongside finances.

- Clear Instructions: If it’s a template for others to use, include brief, clear instructions on how to fill it out and what each section represents.

Remember, the goal is to create a document that is both comprehensive and user-friendly. A well-structured layout encourages accurate tracking and simplifies the often-complex process of cost management, making your budgeting system a true asset.

Your Path to Stress-Free Celebrations and Financial Empowerment

Ultimately, a robust financial organizer isn’t just about spreadsheets and numbers; it’s about empowering you to make confident decisions, reduce stress, and achieve your financial goals, whether for an office party or any other endeavor. This tool transforms abstract financial planning into a concrete, manageable process, providing a crystal-clear picture of your financial landscape.

By embracing a structured approach like that offered by a well-designed financial spreadsheet, you move beyond guesswork and into a realm of informed control. It’s a time-saving asset, a stress-reducing companion, and a financially empowering resource that proves its worth long after the last confetti has been swept away. Make this invaluable resource a cornerstone of your planning, and watch your events flourish without the associated financial anxieties.