The successful repayment of a loan is a significant financial milestone, marking the conclusion of a contractual obligation. Following this achievement, securing official documentation that formally acknowledges the loan’s satisfaction is not merely a formality; it is a critical step in safeguarding financial records and ensuring legal clarity. A loan satisfaction letter serves as this essential proof, confirming that the borrower has fulfilled all terms and conditions, and that any associated liens or encumbrances can be released. This document is invaluable for both the borrower, who requires tangible evidence of repayment, and the lender, who needs to formally close the account and update credit reporting agencies.

Navigating the complexities of financial documentation requires precision and a clear understanding of what constitutes a complete and legally sound record. This is where a well-crafted loan satisfaction letter template proves indispensable. It provides a standardized framework that ensures all necessary information is included, from the loan details and repayment date to the official release of any collateral. Utilizing such a template streamlines the communication process, minimizes potential disputes, and offers peace of mind to all parties involved, solidifying the professional closure of a financial agreement.

The Importance of Written Communication and Professional Documentation

In both business and personal financial matters, the integrity and reliability of written communication are paramount. Oral agreements, while sometimes a starting point, lack the enduring, verifiable quality of formal correspondence. Professional documentation, such as official letters and records, establishes a clear, unambiguous narrative of events and agreements, serving as an immutable reference point. This is particularly crucial in financial transactions, where significant sums of money and legal obligations are at stake.

Written records provide irrefutable evidence of transactions, decisions, and fulfillments. They are essential for compliance with regulatory requirements, for audit purposes, and as a foundation for any future legal proceedings. A comprehensive business letter or notice letter not only conveys information but also formalizes a commitment, creating an official record that can be referenced by all parties for years to come. Such documentation underscores a commitment to transparency and accountability, fostering trust and mitigating risks associated with misunderstandings or memory lapses.

Key Benefits of Utilizing a Structured Loan Satisfaction Letter Template

The adoption of a structured template for any critical communication, and especially for a loan satisfaction letter, offers numerous advantages. Foremost among these is the assurance of consistency and professionalism in every outgoing message. A standardized format ensures that no critical details are overlooked, promoting clarity and completeness in the information conveyed. This level of organization reflects positively on the sender’s attention to detail and commitment to effective communication.

Templates enhance efficiency by reducing the time and effort required to draft documents from scratch. They provide a ready-made document layout that simply needs to be populated with specific details, thereby minimizing human error and accelerating the documentation process. For lenders, this translates to improved operational efficiency and a consistent brand image. For borrowers, receiving a clear, professional communication instills confidence and provides a straightforward official record for their files, ensuring they have robust proof of their fulfilled obligations. The use of a message template truly streamlines the generation of vital formal correspondence.

Customization for Different Formal Notification Purposes

While the primary focus of this discussion is the specific application of a loan satisfaction letter template, the principles of structured formal documentation extend across a wide array of professional and personal scenarios. The underlying concept of acknowledging a completed obligation or formalizing a status change is universally applicable. A well-designed template, therefore, can often be adapted with minor modifications to serve various notification purposes, maintaining a high standard of professional communication.

For instance, the structured format can be re-purposed for an employment verification letter, confirming an individual’s past or current job status. Similarly, a template designed for formal acknowledgements might be customized into a notice letter for other business-related requests or formal declarations, such as acknowledging receipt of a proposal or confirming the conclusion of a service agreement. The core elements — clear identification of parties, precise description of the subject, relevant dates, and explicit statements of status or action — remain crucial regardless of the specific context. This adaptability highlights the value of having a robust document layout for various official records.

When to Use a Loan Satisfaction Letter Template Most Effectively

The application of a loan satisfaction letter template is most effective in specific scenarios where formal, written confirmation of debt repayment is essential. These instances ensure that both the borrower and lender have a clear, verifiable record, protecting their respective interests and facilitating accurate financial reporting.

- Mortgage Payoff: Upon the final payment of a home mortgage, this letter is critical for releasing the lien on the property, allowing the borrower to hold a clear title. It is often required for future property transactions.

- Auto Loan Repayment: Once an auto loan is fully repaid, the correspondence confirms the release of the lien on the vehicle, enabling the borrower to receive the title without encumbrance.

- Personal Loan Completion: For unsecured personal loans, the document serves as proof of full repayment, preventing any future erroneous claims of outstanding debt and positively impacting credit reports.

- Student Loan Repayment: While student loans may not involve physical collateral, obtaining a satisfaction letter confirms the complete fulfillment of the debt, which is crucial for financial planning and record-keeping.

- Release of Collateral: Any loan secured by assets (e.g., equipment, investments) requires a satisfaction letter to formally release the lender’s claim on that collateral once the debt is settled.

- Credit Reporting Agencies: Borrowers can use the letter as an official record to dispute inaccuracies on their credit report if the loan satisfaction is not correctly reflected.

- Refinancing or Future Loans: Having official proof of prior loan satisfaction can streamline the approval process for new loans or refinancing opportunities, demonstrating a clear financial history.

- Estate Planning: In the event of a borrower’s passing, clear records of all satisfied debts simplify the estate settlement process for beneficiaries.

Tips for Formatting, Tone, and Usability

Crafting effective professional communication extends beyond mere content; presentation, tone, and ease of use significantly impact its reception and utility. When utilizing a template for a satisfaction letter, meticulous attention to these details ensures the document is not only informative but also highly professional and readily applicable.

Formatting:

- Clear Headings and Subheadings: Use these to break up the text, making the correspondence easy to scan and comprehend. Headings should be concise and descriptive.

- Consistent Font and Styling: Maintain a professional and uniform appearance throughout the document. Opt for standard, readable fonts like Arial, Calibri, or Times New Roman.

- Ample White Space: Avoid cramming text. Sufficient margins, line spacing, and paragraph breaks improve readability and give the file a clean, organized look.

- Bullet Points and Numbered Lists: Employ these for lists of information, such as loan details or action items, to enhance clarity and quick comprehension.

- Professional Letterhead: If applicable, use an official letterhead for institutional credibility. Ensure accurate contact information is prominently displayed.

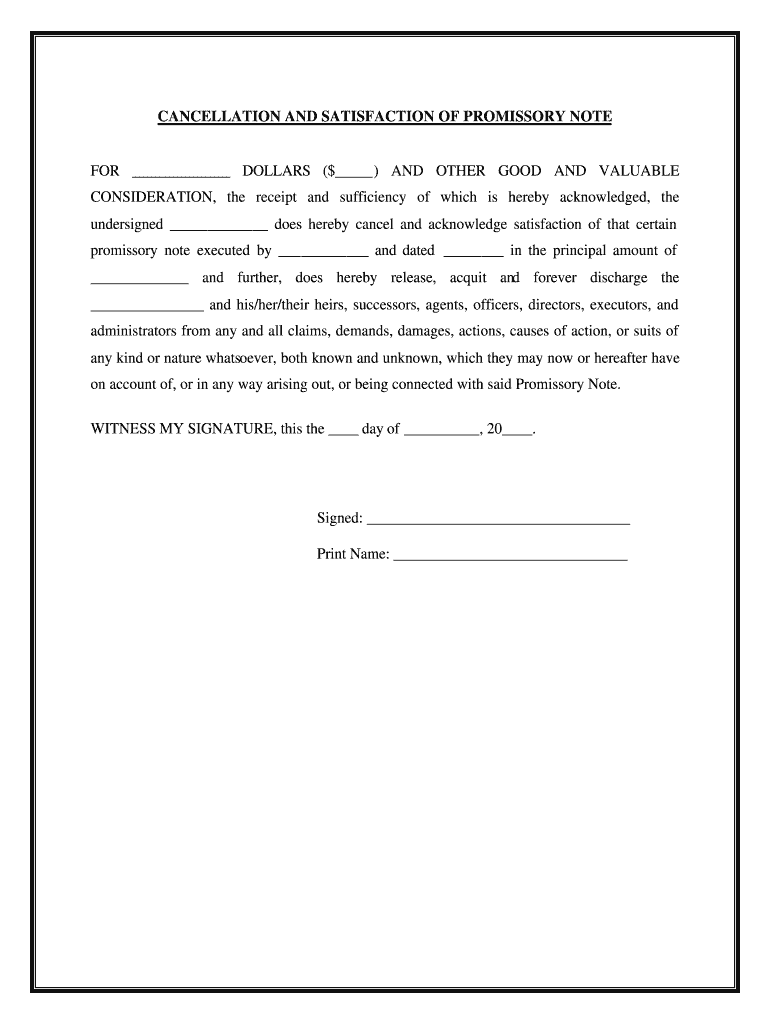

- Signature Block: Include clear spaces for authorized signatures and printed names, along with titles, to validate the document.

Tone:

- Formal and Professional: Maintain a respectful and objective tone throughout. Avoid jargon where possible, but use precise financial terminology when necessary.

- Concise and Direct: Get straight to the point. The purpose of the letter should be immediately evident, without unnecessary preamble or embellishment.

- Unambiguous Language: Use clear, unequivocal phrasing to avoid any potential misinterpretations regarding the loan’s status or the release of obligations.

- Courteous (from Lender): While formal, a lender’s letter can include a brief, professional acknowledgment of the borrower’s successful repayment.

Usability (Print and Digital):

- Print-Friendly Design: Ensure the document layout is suitable for printing. Test how it appears on paper, paying attention to pagination and potential cut-offs.

- Digital Accessibility: Save the final document in a widely accessible format, such as PDF. This preserves formatting, prevents unauthorized edits, and makes the file universally readable.

- Clear Naming Conventions: When saving digital versions, use descriptive file names (e.g., "LoanSatisfaction_BorrowerName_LoanNumber_Date.pdf") for easy retrieval and archiving.

- Metadata: Consider adding relevant metadata to digital documents for improved searchability and organization within digital record systems.

- Ease of Sharing: The letter should be easy to share electronically (e.g., via email attachment) while maintaining its integrity and security.

The meticulous application of these tips ensures that the template produces a high-quality, functional, and professional communication tool that serves its purpose effectively in both print and digital environments.

Ultimately, a professionally crafted loan satisfaction letter template is more than just a piece of paper; it is a vital instrument for clear financial communication and legal certainty. It underscores the importance of thorough documentation in a world where financial transactions are increasingly complex and interconnected. For individuals, it represents concrete proof of fulfilling their obligations, crucial for credit health and future endeavors. For institutions, it streamlines processes, maintains integrity, and reinforces a commitment to professional accountability.

Embracing the use of such a template translates directly into greater efficiency, reduced administrative burden, and enhanced peace of mind for all parties involved in a loan agreement. It solidifies the closing of a significant financial chapter with an unambiguous, official record. In an era where effective business communication is paramount, the template stands as an invaluable asset, ensuring that the critical moment of loan satisfaction is acknowledged with the professionalism and clarity it deserves.