Starting a new venture is an exhilarating journey, often fueled by passion, innovation, and a shared vision among founders. Yet, amidst the excitement of building something new, it’s easy to overlook crucial foundational steps that can prevent significant headaches down the road. One such critical step is establishing clear equity agreements, particularly around founder vesting. This is where a robust founder vesting agreement template becomes an indispensable tool, serving as a roadmap for equity distribution and ensuring everyone is aligned from day one.

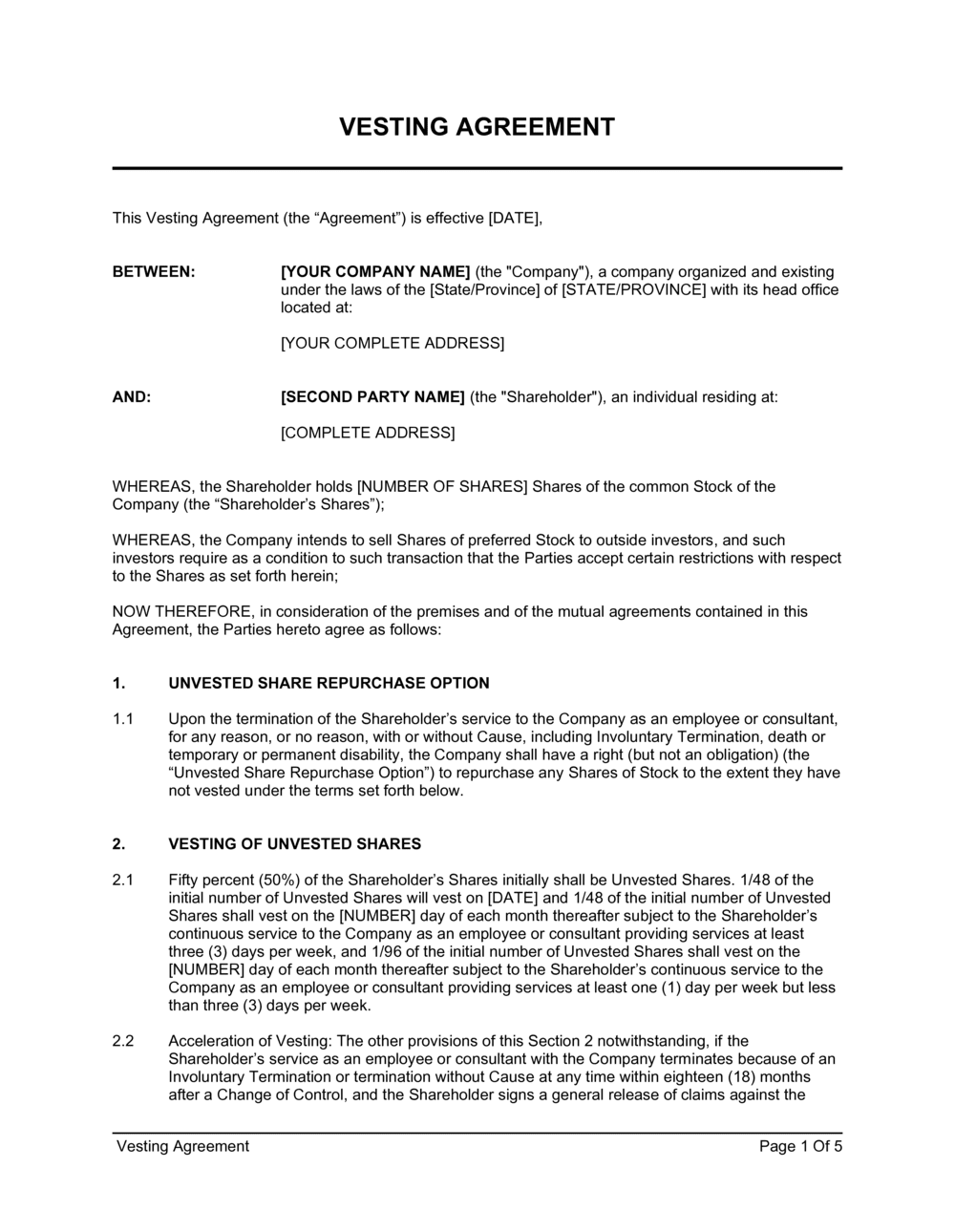

A founder vesting agreement isn’t just a legal formality; it’s a strategic document designed to protect all parties involved, encourage long-term commitment, and provide a clear framework for how equity ownership evolves over time. It’s about setting expectations, defining responsibilities, and safeguarding the company’s future by ensuring that equity is earned, not just granted. For co-founders, early employees, and even future investors, understanding the terms of a founder vesting agreement template provides much-needed clarity and confidence, fostering a stable environment for growth and success.

The Cornerstone of Professional Documentation

In the fast-paced world of startups and small businesses, the importance of organized planning and professional documentation cannot be overstated. Clear, well-structured documents are the bedrock of clarity, legality, and trust within any organization. They transform abstract understandings into concrete agreements, significantly reducing the potential for disputes and misunderstandings that can derail progress and sour relationships. A comprehensive legal contract, meticulously crafted, serves as a reliable reference point, keeping everyone on the same page.

Embracing robust business documentation, such as a detailed service agreement or a thorough memorandum of understanding, is a hallmark of smart business communication. It signals professionalism and attention to detail, instilling confidence in partners, employees, and investors alike. Properly documented processes and agreements also contribute to a strong compliance record, essential for navigating regulatory landscapes and due diligence. This level of organizational discipline empowers teams to focus on core tasks, knowing that the foundational aspects of their professional relationships are legally sound and transparent.

Unlocking Efficiency: Key Benefits of Structured Templates

In today’s productivity-focused environment, leveraging structured templates, forms, or agreement layouts is a game-changer. The most immediate benefit is the enormous amount of time saved; instead of drafting documents from scratch, businesses can quickly populate pre-designed fields with specific information. This efficiency allows teams to allocate their valuable time to strategic initiatives rather than administrative tasks, accelerating the pace of business.

Beyond time-saving, using a consistent contract template ensures uniformity and completeness across all your professional engagements. It significantly reduces the risk of overlooking critical clauses or essential information, which can lead to costly legal disputes down the line. A standardized professional layout enhances clarity, making agreements easier to read, understand, and negotiate, thereby fostering smoother interactions and stronger relationships. Ultimately, these tools are powerful assets for maintaining legal integrity, fostering clear communication, and boosting overall operational efficiency.

Beyond Vesting: Adaptability for Diverse Business Needs

While the focus here is on the specialized nature of founder vesting, the underlying principles of a well-structured business file extend far beyond initial equity agreements. The discipline involved in creating a comprehensive and legally sound document, with clearly defined terms, conditions, and contingencies, is universally applicable. Understanding how to construct such a robust framework means you can adapt this knowledge to a myriad of other professional scenarios. This form represents an organized approach to outlining complex relationships and responsibilities.

For instance, the clarity and thoroughness inherent in such a record can be mirrored in other essential business contracts, like those with vendors or clients. It’s about building a framework that ensures mutual understanding and protection, whether you’re developing a service agreement with a freelancer, establishing a business partnership with co-owners, or setting out terms of service for your customers. Even something as seemingly distinct as a rental agreement can benefit from the same meticulous attention to detail, ensuring all parties are clear on their obligations and rights. By mastering the art of creating precise and comprehensive agreements, you gain a versatile skill applicable across almost every facet of your business operations.

When a Founder Vesting Agreement Template Shines Brightest

A well-crafted founder vesting agreement template is particularly crucial in specific scenarios where equity distribution and long-term commitment are paramount. These are the moments when a structured approach to equity management can make all the difference, fostering transparency and securing the future of the venture.

- At Company Formation: When two or more individuals decide to officially co-found a business, this template ensures that each founder’s equity is earned over time, preventing a situation where an early departure could leave one founder with significant unearned equity.

- During Early-Stage Funding Rounds: As a startup seeks angel investment or seed funding, investors often require clear vesting schedules for founders as a condition of their investment. This demonstrates commitment and minimizes investor risk.

- Bringing on Key Advisors or Early Employees with Equity: Beyond just founders, this form is vital when granting equity to crucial early team members or advisors. It ensures their equity aligns with their sustained contribution to the company’s success.

- When Establishing Equity Grant Programs: For businesses planning broader employee equity programs, the principles embedded within the document provide a solid framework for how options or restricted stock units will vest over specified periods.

- Post-Acquisition Integration Planning: In scenarios where a startup is acquired, the vesting schedule outlined in the contract helps determine how founder equity accelerates or is treated upon a change of control, providing clarity during complex transitions.

- To Mitigate "Dead Equity" Risks: It actively prevents "dead equity," where a founder or early contributor leaves but retains a substantial, unearned stake, hindering future equity allocation and dilution for active team members.

Crafting Clarity: Design and Usability Tips

Beyond the legal language, the design and formatting of any important document significantly impact its usability and effectiveness. For a crucial agreement like this, readability is paramount, ensuring that all parties can easily understand its terms without professional legal interpretation. Start with clear, logical headings and subheadings that break down complex information into digestible sections. Generous white space around text and between paragraphs enhances visual appeal and reduces eye strain, making the document much less intimidating to read. Always opt for legible fonts, such as Arial or Georgia, in a comfortable size (10-12 points for body text) to accommodate both print and digital versions.

When dealing with detailed information, such as vesting schedules, equity percentages, or key performance indicators, employing tables and bulleted lists can drastically improve comprehension. These structures organize data cleanly, making it easy to scan and reference specific points. Crucially, aim for plain language wherever possible, avoiding excessive legal jargon or providing clear definitions for unavoidable technical terms. For digital versions, ensure the layout is easily convertible to PDF, supports fillable fields for data entry, and is compatible with various document signing platforms, facilitating efficient document signing. For print, pay attention to margins, page breaks, and ensure a clear version control system is in place, including dates and revision numbers, to prevent confusion between different iterations of the agreement.

A Smart Step Towards Business Success

In the journey of building a successful business, the foundation you lay in the early stages can dictate your trajectory for years to come. By prioritizing organized planning and utilizing professional documentation, you’re not just creating paperwork; you’re building a framework for trust, transparency, and sustainable growth. The strategic deployment of a robust founder vesting agreement template is a testament to smart business communication and an unwavering commitment to clarity.

This critical template serves as more than just a legal safeguard; it’s a powerful tool for productivity, allowing founders to focus on innovation and execution with confidence. It ensures that equity, the lifeblood of a startup, is earned through sustained effort and commitment, aligning everyone’s incentives for the long haul. Ultimately, leveraging a well-structured founder vesting agreement template is about setting your business up for success, ensuring that all stakeholders have a clear path forward, and fostering an environment where shared vision can truly flourish without unnecessary friction.