The accurate and timely resolution of financial obligations is a cornerstone of both sound business practices and responsible personal financial management. When payment for goods, services, or loans becomes overdue, a structured approach is essential for pursuing resolution while preserving professional relationships where possible. This is precisely where a formal demand for payment letter template becomes an indispensable tool. It serves as a clear, unequivocal written notice, articulating the outstanding debt and outlining expectations for its settlement.

This comprehensive guide is designed for individuals, small business owners, and large enterprises alike who seek to professionalize their debt recovery efforts. By utilizing a carefully constructed formal demand for payment letter template, recipients can communicate their position with authority and clarity, ensuring that all necessary details are conveyed without ambiguity. This not only streamlines the recovery process but also establishes an official record, which can be crucial should further action become necessary.

The Importance of Written Communication and Professional Documentation

In any transaction, whether commercial or personal, clear and concise communication forms the bedrock of understanding and agreement. Verbal agreements, while sometimes convenient, often lack the precise detail and irrefutable proof that written documentation provides. When disputes arise, or obligations are not met, the absence of a written record can lead to prolonged disagreements, misunderstandings, and an inability to legally enforce terms.

Professional documentation, such as official records and formal correspondence, transcends casual interactions by providing a verifiable account of events, requests, and agreements. It establishes a factual basis for any claim or demand, making it significantly harder for a recipient to deny receipt or misinterpret the sender’s intentions. For businesses, this commitment to meticulous record-keeping is vital for legal compliance, audit readiness, and maintaining a reputable image. For individuals, it offers protection and clarity in complex situations, serving as a robust official record of interactions and demands.

Key Benefits of Using Structured Templates for Formal Demand For Payment Letter Template

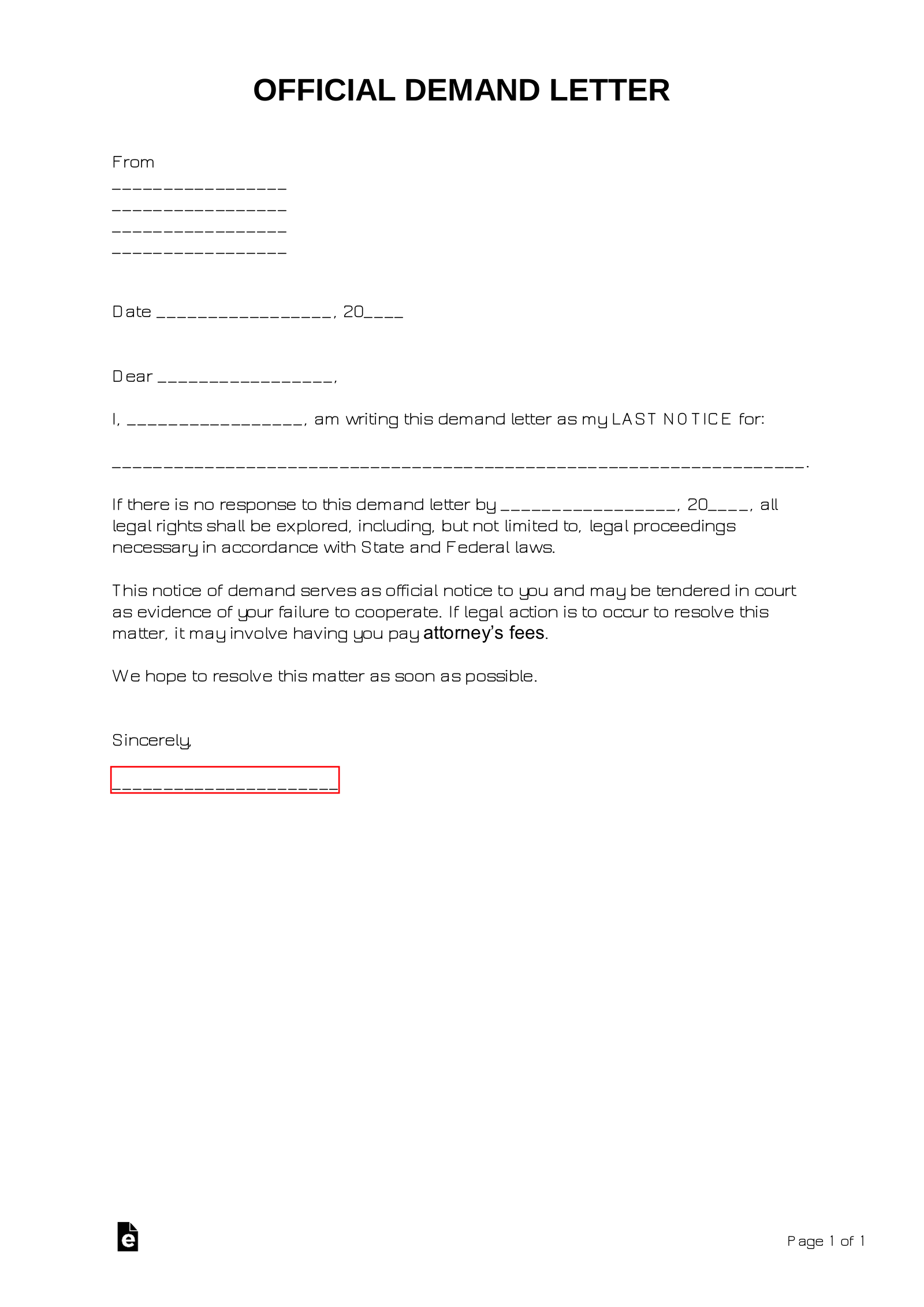

Employing a structured template for critical communications like a formal demand for payment letter template offers numerous advantages that contribute to efficiency, professionalism, and legal robustness. Firstly, it ensures consistency across all debt recovery efforts. This uniformity in presentation and content reinforces the sender’s organized approach and dedication to formal processes, signaling the seriousness of the situation to the recipient.

Secondly, the systematic layout inherent in such a message template significantly enhances clarity. Each section is designed to convey specific information—such as the amount owed, the basis of the debt, and the payment deadline—without unnecessary jargon or emotional language. This directness helps to prevent misinterpretation and focuses the recipient’s attention squarely on the outstanding obligation. Furthermore, using a predefined document layout helps in maintaining professionalism, even in challenging situations, by ensuring that all necessary legal and financial details are systematically included. This structured approach not only saves time by eliminating the need to compose each letter from scratch but also reduces the risk of overlooking critical information, thereby strengthening the validity and effectiveness of the professional communication.

Customizing the Template for Various Applications

While the core objective of requesting payment remains constant, the formal demand for payment letter template is remarkably versatile and can be adapted to a multitude of situations across employment, business, and personal spheres. Its fundamental structure provides a robust framework that can be tailored to address specific contractual obligations, outstanding invoices, or other financial liabilities. This adaptability makes it a valuable asset for diverse scenarios requiring a clear, written request for funds.

For employment-related issues, for instance, the document can be customized to demand unpaid wages, overdue commissions, or severance packages as per an employment contract. In a business context, the correspondence is frequently modified to address past-due invoices, breach of contract resulting in financial loss, or the fulfillment of specific performance demands where payment is contingent upon certain actions. Individuals might leverage the letter to request the return of loaned money, compensation for damages, or fulfillment of personal agreements where a monetary sum is owed. Each application requires careful adjustment of specific details, referencing relevant agreements or invoices, and clearly stating the exact amount and the basis for the demand.

When Using a Formal Demand For Payment Letter Template is Most Effective

The strategic deployment of a formal notice significantly enhances the likelihood of resolving outstanding financial issues without resorting to more drastic measures. This type of structured demand is particularly effective in scenarios where previous informal attempts at collection have been unsuccessful or where a clear legal record needs to be established.

Consider the following situations where employing this formal correspondence is most impactful:

- Past-due Invoices: When initial reminders or statements for services rendered or goods delivered have gone unacknowledged, this letter serves as a final, strong request before escalating.

- Unpaid Debts from Loans or Services: For personal loans, consulting fees, or other service-based debts that have not been honored, this provides a clear, documented claim.

- Breach of Contract: If a contractual agreement has been violated, leading to a monetary sum being owed, the document can formally demand restitution or specified damages.

- Disputes Over Goods/Services: When a client or customer withholds payment claiming dissatisfaction, but the terms of service have been met, this letter clarifies the expectation of payment.

- Rent Arrears or Property Damage: Landlords can use this formal request to demand overdue rent or compensation for property damage beyond normal wear and tear.

- Settlement Offers Before Litigation: Prior to initiating legal proceedings, this type of letter can serve as a final attempt to settle the debt out of court, often outlining the intent to pursue further action if payment is not received.

- Formal Notice of Intent to Escalate: It acts as an official record signaling that the sender is serious about recovering the debt and is prepared to take further steps, such as involving collection agencies or legal counsel.

Tips for Formatting, Tone, and Usability

The efficacy of any formal correspondence, especially a demand for payment, heavily relies on its presentation, the tone it conveys, and its practical usability. Adhering to best practices in these areas ensures that the message is received as intended—professional, serious, and unambiguous.

Formatting:

The physical or digital layout of the letter plays a crucial role in its reception. Use a clean, professional font (e.g., Times New Roman, Arial) at a legible size (10-12pt). Ensure proper spacing between paragraphs and clear headings for different sections, if applicable. The document must include your full contact information, the current date, and the recipient’s full contact information at the top. A clear subject line, such as "Formal Demand for Payment – Invoice # [Number]," is essential for immediate identification. Include a reference number or invoice number to directly link the demand to the specific debt.

Tone:

The tone of this formal correspondence must be firm, professional, and entirely factual. Avoid emotional language, accusatory statements, or personal attacks. The goal is to convey seriousness and resolve, not anger or frustration. Stick to objective details: state the amount owed, the basis of the debt (e.g., "per invoice #123 dated October 26, 2023"), the original due date, and the new payment deadline. Clearly outline the consequences of non-payment without resorting to threats. A calm, authoritative tone underscores your professionalism and legal standing.

Usability:

Consider how the letter will be used by both sender and recipient. For print versions, ensure there is space for a physical signature and that it is mailed via certified mail with a return receipt requested, creating an official record of delivery. For digital versions, send it as a PDF attachment to an email, making it tamper-proof and professional. The email subject line should mirror the letter’s subject, making it easy to identify. Ensure the document is accessible and readable on various devices. Providing clear instructions for payment methods and contact information for inquiries enhances usability, facilitating a smoother resolution process for the recipient.

In conclusion, the strategic use of a formal demand for payment letter template serves as a critical component of effective financial communication and debt resolution. It provides a robust framework for articulating overdue financial obligations with clarity, professionalism, and legal precision. By leveraging this structured approach, individuals and organizations can significantly enhance their ability to recover outstanding funds while maintaining a professional stance and establishing an indisputable official record of their efforts.

This powerful communication tool is more than just a request for money; it is a clear statement of intent and an invitation for resolution before further action becomes necessary. Its inherent consistency and comprehensive nature make it an indispensable asset in navigating the often-challenging landscape of overdue payments. Ultimately, embracing this reliable and efficient communication tool can lead to more favorable outcomes, reinforcing responsible financial practices and fostering clearer, more accountable relationships.