Navigating the path to financial recovery can be a complex journey, often filled with intricate details and sensitive personal information. For both individuals seeking assistance and the professionals offering it, a robust framework is essential to ensure clarity, set expectations, and build trust. This is precisely where a well-crafted credit repair contract agreement comes into play. It’s not just a formality; it’s a foundational document that underpins the entire process, providing a clear roadmap for all parties involved.

Think of the credit repair contract agreement as your co-pilot in this essential financial endeavor. Its primary purpose is to define the scope of services, outline responsibilities, establish payment terms, and articulate the rights and obligations of both the client and the service provider. For those who value productivity, organization, and smart business communication, understanding the nuances of such an agreement is paramount. It serves as a bulwark against misunderstandings, ensuring that every step taken toward improved credit is deliberate, documented, and legally sound.

The Cornerstone of Professional Documentation: Clarity, Legality, and Trust

In any professional interaction, especially those involving financial services, the importance of clear, organized planning and professional documentation cannot be overstated. Disorganized paperwork, vague verbal agreements, or incomplete forms are notorious breeding grounds for confusion, disputes, and ultimately, damaged trust. A meticulously prepared legal contract, like the one for credit repair, actively works to prevent these pitfalls by leaving no room for ambiguity. It’s a testament to good business practice, demonstrating a commitment to transparency and mutual understanding.

Structured documentation provides a crucial compliance record for all parties. It acts as a single source of truth, detailing what was agreed upon, when, and by whom. This level of clarity protects both the service provider from baseless claims and the client from unmet promises. Ultimately, a strong service agreement fosters an environment of trust, which is invaluable when dealing with the sensitive nature of personal finances and the journey toward credit restoration. Embracing professional layouts for all your business documentation isn’t just about looking good; it’s about being robust.

Unlocking Efficiency: The Benefits of Structured Templates and Forms

Utilizing structured templates, forms, or agreement layouts offers a wealth of benefits that directly impact efficiency and professionalism. Firstly, they save an enormous amount of time. Instead of drafting a new agreement from scratch for each client, a well-designed contract template allows you to quickly populate specific details, ensuring consistency across all your engagements. This standardization streamlines your onboarding process, freeing up valuable time that can be redirected to core services or business development.

Beyond time-saving, a professional layout ensures consistency in your brand’s communication and legal posture. Every client receives the same high standard of documentation, reflecting positively on your professionalism and attention to detail. Such structured documents also significantly reduce the likelihood of errors or omissions that could have legal ramifications down the line. They provide a clear framework, reminding you of all the essential clauses and disclosures needed for a comprehensive and compliant business file.

Versatility in Action: Adapting Your Agreement for Diverse Needs

While we’re focusing on credit repair, the principles behind a robust agreement are incredibly versatile and can be adapted for a multitude of purposes. The fundamental need for clarity, mutual understanding, and legal protection transcends specific industries. Whether you’re drafting a business partnership agreement, outlining terms of service for a new app, or even preparing a rental agreement, the core components remain consistent. The ability to articulate scope, responsibilities, and dispute resolution mechanisms is universally valuable.

Freelancers, for instance, can adapt the structure to create comprehensive service agreements with their clients, ensuring project deliverables and payment schedules are crystal clear. Small businesses can use similar layouts for vendor contracts or even a memorandum of understanding with a strategic partner. The underlying structure encourages you to think through all potential scenarios, making sure your business documentation is exhaustive and protective, no matter the context.

When a Credit Repair Contract Agreement Shines Brightest

A comprehensive credit repair contract agreement is most effective in several critical scenarios, ensuring both parties are fully aligned and protected. These moments are key to a smooth and successful credit repair journey:

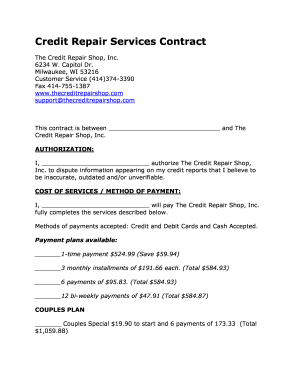

- Initial Client Onboarding: This is the first and most crucial point. A detailed credit repair contract agreement establishes the entire scope of work, fees, and expectations right from the start. It sets a professional tone and ensures the client understands the commitment involved.

- Defining Service Scope: Clearly outlining what services will be provided (e.g., reviewing credit reports, disputing inaccuracies, offering financial coaching) and what falls outside the scope prevents future misunderstandings. It precisely details the value being delivered.

- Establishing Fee Structures and Payment Terms: Transparency about costs, payment schedules, and any potential additional fees is vital. This section of the document prevents financial disputes and ensures smooth transactions, often including clauses for late payments or cancellation.

- Client Responsibilities: Clearly stating what the client needs to provide (e.g., credit reports, personal information, timely responses) is as important as outlining the provider’s duties. This ensures a collaborative effort toward the common goal.

- Dispute Resolution Procedures: A well-structured agreement will include clauses detailing how disputes (should they arise) will be handled, whether through mediation, arbitration, or other legal avenues. This provides a clear path forward without resorting to costly litigation.

- Termination Clauses: Outlining the conditions under which either party can terminate the agreement, along with any associated penalties or refunds, provides an exit strategy that is fair and legally sound.

- Compliance and Disclosures: The contract ensures all necessary legal disclosures, such as those required by the Credit Repair Organizations Act (CROA) in the US, are made upfront, protecting both the client and the service provider. This makes the business file a complete record.

Crafting Your Document for Optimal Impact: Design and Usability Tips

Creating a document that is both legally sound and highly usable requires attention to design and formatting. A truly effective agreement isn’t just about the words; it’s also about how they are presented. For both print and digital versions, focus on readability and clarity. Use clean, professional fonts and ensure ample white space to prevent the document from looking cluttered or intimidating. Breaking up long blocks of text with headings, subheadings, and bullet points significantly improves comprehension.

Consider the user experience for document signing. If it’s a digital form, ensure it’s easily fillable and compatible with e-signature platforms. For print versions, clear lines for signatures and dates are essential. Use plain language, avoiding excessive legal jargon wherever possible, or providing clear definitions for complex terms. A well-designed professional layout communicates professionalism and makes the entire process of engaging with the contract feel more straightforward and less daunting. Remember, a good record is one that’s easily understood and referenced.

The Practical Value of a Solid Agreement

Ultimately, a meticulously prepared agreement for credit repair services, or indeed any significant service, stands as a testament to professionalism and proactive planning. It’s more than just a piece of paper; it’s a powerful communication tool that sets the stage for a productive and trusting relationship. By investing the time to create a clear, legally sound, and user-friendly agreement, you are not just ticking a box for compliance; you are actively building a foundation for success.

This kind of detailed contract template saves you valuable time, minimizes potential conflicts, and ensures that all parties are on the same page from the outset. It provides peace of mind, allowing both the client and the service provider to focus on the core objective: achieving financial well-being. Embrace the power of well-structured business documentation to elevate your professional interactions and secure better outcomes.