In both professional and personal spheres, the ability to communicate clearly, concisely, and effectively is paramount. This holds especially true when engaging in activities that require careful documentation and adherence to established protocols, such as acknowledging financial contributions. A well-crafted charitable donation letter template serves as an indispensable tool in this context, providing a structured framework for expressing gratitude and confirming the details of a donation. Its primary purpose is to streamline the process of acknowledging gifts, ensuring that both the donor and the recipient organization maintain accurate records while fostering positive relationships.

This document benefits a wide array of stakeholders. Donors receive official acknowledgment, which can be crucial for tax purposes and provides assurance that their contribution has been received and appreciated. Non-profit organizations and charitable entities, on the other hand, benefit from enhanced operational efficiency, reduced administrative burden, and the ability to project a consistent, professional image. By standardizing communication, the charitable donation letter template reinforces transparency and trust, essential elements in the philanthropic landscape, thereby strengthening the bond between an organization and its supporters.

The Importance of Professional Written Communication

The bedrock of effective operations in any business, non-profit, or even personal endeavor is robust written communication. Professional documentation, whether it’s an internal memo, a client proposal, or formal correspondence like a donation acknowledgment, establishes credibility and provides an immutable record. Unlike verbal exchanges, written documents offer a verifiable account of interactions, decisions, and commitments, mitigating misunderstandings and disputes. They are critical for legal compliance, auditing, and maintaining institutional memory.

Moreover, polished written communication reflects positively on the sender or organization. It conveys attention to detail, a commitment to clarity, and respect for the recipient’s time and intelligence. In an era dominated by rapid, informal digital exchanges, the thoughtful application of formal communication principles in documents such as a business letter or an official record stands out, underscoring professionalism and gravitas. This deliberate approach ensures that crucial messages are not only delivered but also received and understood with the intended weight and importance.

Key Benefits of Using a Structured Template for Donation Letters

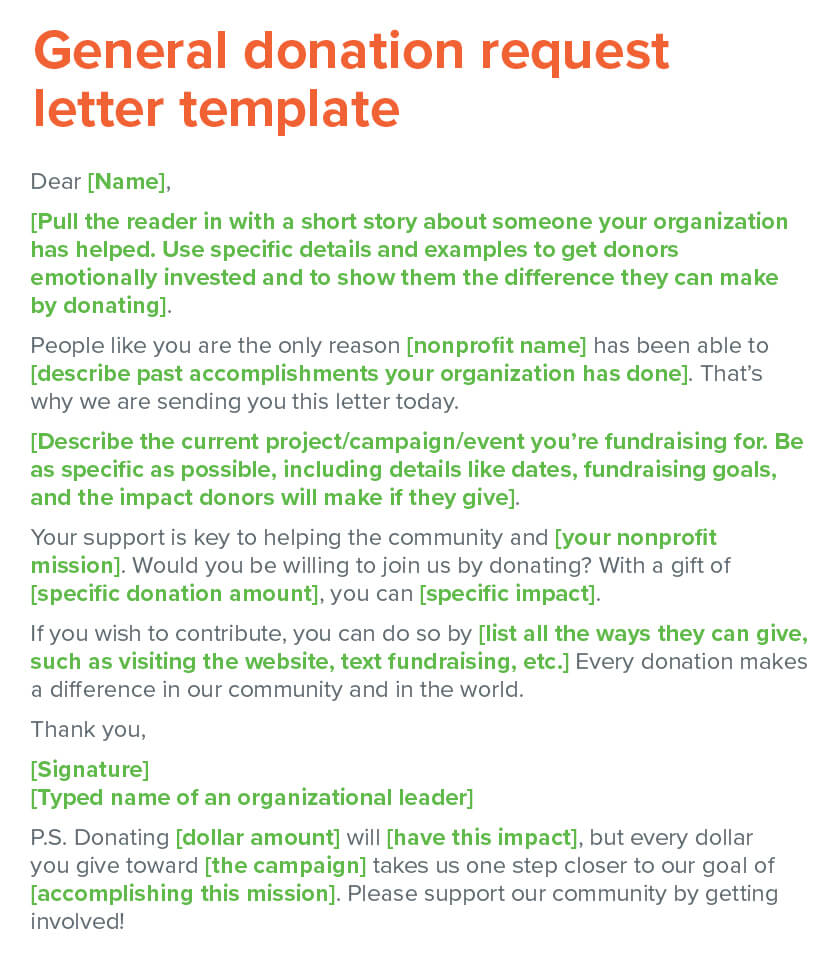

Adopting a structured approach, particularly through the use of a pre-designed message template, offers significant advantages for organizations consistently handling donations. Utilizing a specific framework, such as a charitable donation letter template, helps maintain professionalism across all donor interactions. It ensures that every communication upholds the organization’s standards, reflects its brand voice, and includes all necessary legal and appreciative components. This consistency is vital for building and preserving donor confidence and loyalty.

Beyond professionalism, consistency in communication is a major benefit. A template guarantees that key information—such as the donor’s name, donation amount, date, tax-deductible status, and a warm thank you—is never overlooked. This uniformity prevents errors, reduces the need for constant review, and ensures compliance with regulations that often govern charitable contributions. Furthermore, the clarity afforded by a well-organized document layout minimizes ambiguity, ensuring donors clearly understand their contribution’s impact and their tax-deductible benefits, which is a hallmark of effective professional communication.

Customizing Your Template for Diverse Applications

While the core purpose of a donation acknowledgment remains constant, the value of a robust charitable donation letter template extends beyond a single, static application. Its inherent structure is designed for adaptability, allowing organizations to customize it for various scenarios, ranging from different types of donations to specific organizational needs. For instance, a template acknowledging an in-kind gift will differ slightly from one for a monetary contribution, requiring distinct fields for item description and valuation.

The flexibility of such a document means it can be modified to serve purposes far beyond just donation receipts. With minor adjustments, the underlying principles of the file can be repurposed for a notice letter, a cover letter for a grant application, or even a formal request for support. This modularity means an organization invests once in a high-quality template, then reaps benefits across multiple communication needs. The ability to quickly and easily tailor the correspondence while maintaining a consistent professional tone significantly enhances operational efficiency and communication outreach.

Optimal Scenarios for Utilizing a Donation Letter Template

The strategic deployment of a pre-formatted letter significantly enhances efficiency and professionalism in numerous contexts. Leveraging such a structured document ensures that critical communications are handled effectively and consistently. Here are several scenarios where utilizing this template is most effective:

- Acknowledging Monetary Gifts: For all cash, check, or electronic donations, this template provides a swift and accurate way to confirm receipt, express gratitude, and provide essential tax-deductible information. It ensures compliance with IRS regulations (e.g., for donations over $250 requiring a contemporaneous written acknowledgment).

- Confirming In-Kind Contributions: When donors provide goods, services, or property rather than money, a specific section within the letter can detail the donated item, its estimated value, and the date of receipt, crucial for both the organization’s records and the donor’s tax purposes.

- Responding to Grant Awards: While more formal than a typical donation, a modified version of the template can serve as a professional acknowledgment of grant funding, ensuring the grantmaker receives timely confirmation and appreciation for their support.

- Thanking Volunteers for Pro Bono Services: Although often not tax-deductible in the same way as monetary gifts, acknowledging significant pro bono services with a formal letter demonstrates appreciation and strengthens relationships with dedicated supporters.

- Annual Giving Campaign Follow-ups: At the close of a campaign, a personalized version of the template can be used to thank all donors collectively or individually, reinforcing their impact and encouraging future engagement.

- Memorial or Honorary Donations: These sensitive contributions require a specially worded acknowledgment that recognizes the person being honored or remembered, often with a separate notification sent to the family. The template can be adapted to include these specific details and sensitivities.

- Corporate Sponsorships: For businesses sponsoring events or programs, the letter can confirm the sponsorship level, benefits received, and reiterate the organization’s gratitude, laying the groundwork for future partnerships.

Each of these applications benefits from the inherent structure and pre-defined sections of the letter, guaranteeing that no crucial detail is missed and every communication maintains a high standard of professionalism and warmth.

Formatting, Tone, and Usability Best Practices

Effective formal correspondence, especially documents like this, requires careful attention to formatting, tone, and usability. The layout should be clean, logical, and easy to read. Utilize standard business letter formatting: a professional header with the organization’s logo and contact information, followed by the date, donor’s contact information, a clear salutation, body paragraphs, and a professional closing. Employ clear headings and bullet points where appropriate to break up text and highlight key information, such as the donation amount or tax-deductibility statement. Margins should be standard (1 inch all around), and a readable font (e.g., Arial, Calibri, Times New Roman) in a size between 10-12 points is recommended.

The tone of the correspondence must be consistently grateful, appreciative, and professional. It should convey genuine thanks without being overly effusive or casual. Maintain an authoritative yet approachable voice, reflecting the organization’s integrity and respect for its donors. Avoid jargon and ensure the language is accessible to all recipients. For usability, consider both print and digital versions. For print, ensure high-quality paper and clear printing. For digital versions (e.g., PDF attachments in emails), optimize the file size for quick download and ensure it is accessible across various devices and screen readers. Include clear contact information for any donor inquiries. A well-designed message template should be intuitive for staff to complete and straightforward for donors to understand, making the entire process seamless.

Conclusion: The Enduring Value of a Structured Letter

In the complex ecosystem of charitable giving, efficient and respectful communication is not merely an option; it is a necessity. The structured letter, as an official record of generosity, stands as a testament to an organization’s commitment to professionalism and transparency. Its systematic design ensures that every donor receives a consistent, accurate, and heartfelt acknowledgment, reinforcing the trust that underpins successful philanthropy. By providing a clear framework, this type of professional communication minimizes administrative effort while maximizing donor satisfaction and loyalty.

Ultimately, embracing such a meticulously designed document layout is an investment in an organization’s future. It facilitates compliance, streamlines operations, and critically, strengthens the vital relationships with those who make its mission possible. In an era where clarity and efficiency are prized, the value of a reliable and well-crafted template as a communication tool is undeniable, proving to be an indispensable asset for any organization dedicated to making a positive impact.