Planning an annual dinner, whether it’s a corporate gala, a family reunion, or a significant celebratory event, often comes with a surprising amount of financial stress. Juggling vendor quotes, catering costs, venue fees, and myriad small expenses can quickly turn an exciting endeavor into a daunting task. Without a clear financial roadmap, it’s easy to overspend, lose track, and feel overwhelmed by the process.

This is precisely where a robust budgeting tool becomes not just helpful, but essential. Imagine having a clear, organized system that allows you to track every penny, compare actual costs to your initial estimates, and ensure you stay within your financial comfort zone. That’s the power of the annual dinner budget worksheet template – a practical, pre-structured solution designed to bring clarity and control to your event financial planning, benefiting anyone from busy professionals to meticulous home organizers.

Why Organized Financial Planning is Your Best Friend

In today’s fast-paced world, whether you’re managing personal finances or the budget for a small business, organized financial planning is paramount. It’s the cornerstone of clarity, providing a panoramic view of where your money comes from and, more importantly, where it goes. This level of insight translates directly into greater control over your financial destiny, helping you make informed decisions rather than reactive ones.

Maintaining meticulous records acts as your personal financial organizer, reducing stress by eliminating guesswork and uncertainty. When you know your numbers, you can anticipate challenges, identify opportunities for savings, and ultimately achieve your financial goals with greater ease. A well-kept expense tracker isn’t just about documenting past transactions; it’s a proactive tool that empowers you to shape your future financial landscape.

Unlocking the Power of Structured Templates for Budgeting

The beauty of using structured templates, planners, or financial spreadsheets for budgeting lies in their inherent design for efficiency and accuracy. Instead of starting from scratch every time, a template provides a proven framework, ensuring you don’t overlook crucial categories or underestimate potential costs. This systematic approach fosters a robust budgeting system, making the entire process far less intimidating.

These tools offer significant advantages, from fostering accuracy in your financial projections to enabling easy comparison between different scenarios or historical data. They help you identify areas where you can optimize spending, uncover hidden costs, and ultimately become a more effective savings planner. By standardizing your approach, you gain consistency, save valuable time, and build confidence in your ability to manage finances effectively.

Beyond the Dinner Table: Adapting Your Budget Template

While this discussion centers around the annual dinner budget worksheet template, the underlying principles and structure are incredibly versatile. The same organizational framework can be effortlessly adapted for a wide range of financial management tasks, proving its utility far beyond a single event. Its flexibility makes it an indispensable tool for various aspects of your financial life.

For personal finance, it can transform into a comprehensive monthly expenses tracker, helping you monitor income log and outflow, or even serve as a specialized savings planner for larger goals like a down payment or vacation. Small businesses can repurpose the layout for project-specific budgeting, tracking advertising campaigns, or even forecasting quarterly cash flow. Within household management, it’s perfect for managing renovation costs, tracking utility bills, or planning for holiday spending. This adaptable nature means you get far more mileage out of a well-designed financial spreadsheet than just its initial intended purpose.

When to Deploy Your Annual Dinner Budget Worksheet Template

The annual dinner budget worksheet template truly shines in situations where multiple expenses converge for a single, significant event. Its structured approach helps prevent oversight and provides a clear financial picture from start to finish. Here are some scenarios where deploying this specific template proves most effective:

- Corporate Holiday Parties: Managing catering, venue rental, entertainment, decorations, and gifts for employees. This sheet ensures every line item is accounted for and stays within the company’s allocated budget.

- Fundraising Galas: Tracking donations, ticket sales, sponsor contributions, and event expenditures like marketing, speakers, and silent auction items. This helps assess profitability and return on investment.

- Milestone Anniversary Dinners: For large family gatherings or significant celebrations, it helps manage costs for catering, special decor, photography, and personalized favors.

- Large-Scale Wedding Rehearsal Dinners: Even if the main wedding has its own budget, a dedicated template for the rehearsal dinner keeps these specific costs separate and manageable.

- Client Appreciation Dinners: For businesses hosting important clients, this template allows for meticulous cost management, ensuring a memorable experience without unexpected overruns.

- Association Annual Meetings with Dinner Events: Beyond meeting logistics, this tool helps track food and beverage minimums, audio-visual needs for presentations, and guest speaker fees associated with the dinner portion.

- Significant Personal Celebrations: Any large personal event involving multiple vendors and services, such as a major birthday celebration or retirement party, benefits from this detailed financial organizer.

Designing Your Template for Maximum Impact (Print & Digital)

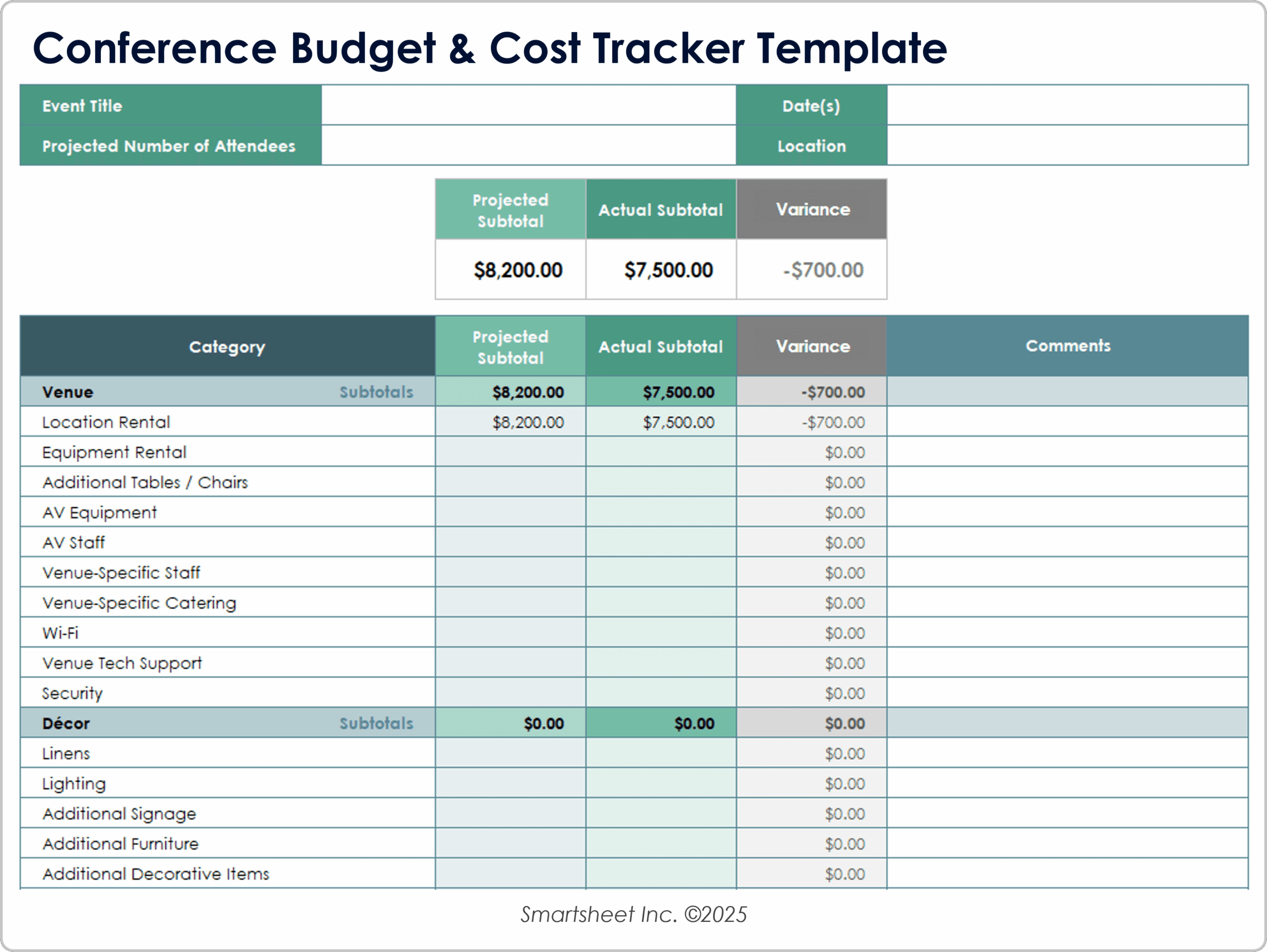

A well-designed budget template isn’t just about functionality; it’s about usability and visual clarity, whether you’re viewing it on a screen or holding a printout. For both print and digital versions, start with intuitive categories that mirror common event expenses, like "Venue," "Catering," "Entertainment," "Decorations," "Marketing," and "Miscellaneous." Each category should have sub-items, allowing for granular tracking, perhaps detailing "food," "drinks," and "staffing" under "Catering."

Include columns for "Estimated Cost," "Actual Cost," and "Difference" to easily see your variance. Adding a "Notes" column for vendor contact info or payment due dates can be incredibly helpful. For digital versions, leverage spreadsheet software features: use formulas to auto-calculate totals, conditional formatting to highlight over-budget items in red, and create summary tabs for a high-level overview. Consider adding an income log section for events that generate revenue, like ticket sales, to create a holistic balance sheet. For print, ensure legible fonts, sufficient white space, and logical flow across pages. A clear cost management system empowers you to make smarter financial decisions.

Tips for Better Design, Formatting, and Usability

To make your financial spreadsheet truly effective, focus on a few key design principles. Keep the layout clean and uncluttered; too much information can be overwhelming and counterproductive. Use consistent formatting, such as bolding category headers and aligning numbers properly, to enhance readability. Color-coding can be a powerful visual aid, for instance, using one color for actual expenses and another for estimated ones.

When designing for digital use, think about automation. Simple formulas for summing up columns or calculating percentages can save immense time and reduce errors. Data validation, like drop-down menus for expense categories, can ensure consistent data entry. For a physical printout, ensure it fits comfortably on standard paper sizes and has ample space for handwritten notes if needed. Remember, the goal is to create a tool that simplifies your financial planning, not complicates it.

Creating and consistently using a budget worksheet is a powerful step towards financial empowerment, transforming daunting tasks into manageable projects. It brings a sense of calm and control to what can often be a chaotic experience, ensuring your focus remains on the joy of the event rather than the stress of the bills. This proactive approach to cost management provides a clear financial roadmap, guiding you away from unexpected overspending.

Ultimately, whether you call it a template, a financial organizer, or simply "the planner," the practical value of this sheet is undeniable. It’s a time-saving, stress-reducing, and financially empowering tool that equips you with the insights needed to make smart decisions. Embrace the power of organized budgeting, and you’ll find yourself not only more confident in your financial planning but also free to truly enjoy the moments that matter most.